John Maynard Keynes is credited with saying that “markets can remain irrational longer than you can remain solvent.” This statement highlights two critical insights:

- The first is that markets do not always behave in a rational way, particularly when viewed over shorter-term periods of time.

- The second is that, while one may eventually be right, there is typically a cost associated with being early.

We would propose this as a useful framework as we look ahead and discuss the current landscape and potential portfolio implications. Skipping to the punchline, we continue to think that markets, both equities and fixed income, are priced almost to perfection. It is entirely possible that a perfect scenario plays out, though we would argue that the logic is counterintuitive and therefore not probable. We believe there are steps that investors can take to prepare for less favorable outcomes, and we will lay those out in our portfolio implications section. But first, we think it is important to look at some of the factors that have gotten us to this point.

The AI Hype Train: All Aboard, But Buckle Up

We are in the midst of a major evolution. We are long-term optimists and believe that AI will be transformative, much like the internet was following the turn of the century. I recently sat for an interview with Mandate Wire and discussed the impact on logistics that refined data sets could have. The key takeaway was that the value generated will be highly contingent on the specificity and uniqueness of the data on which the model is trained and deployed. We are still just scratching the surface on the applications related to agentic AI and models trained on unique, sophisticated, and proprietary datasets. The future could indeed be very bright.

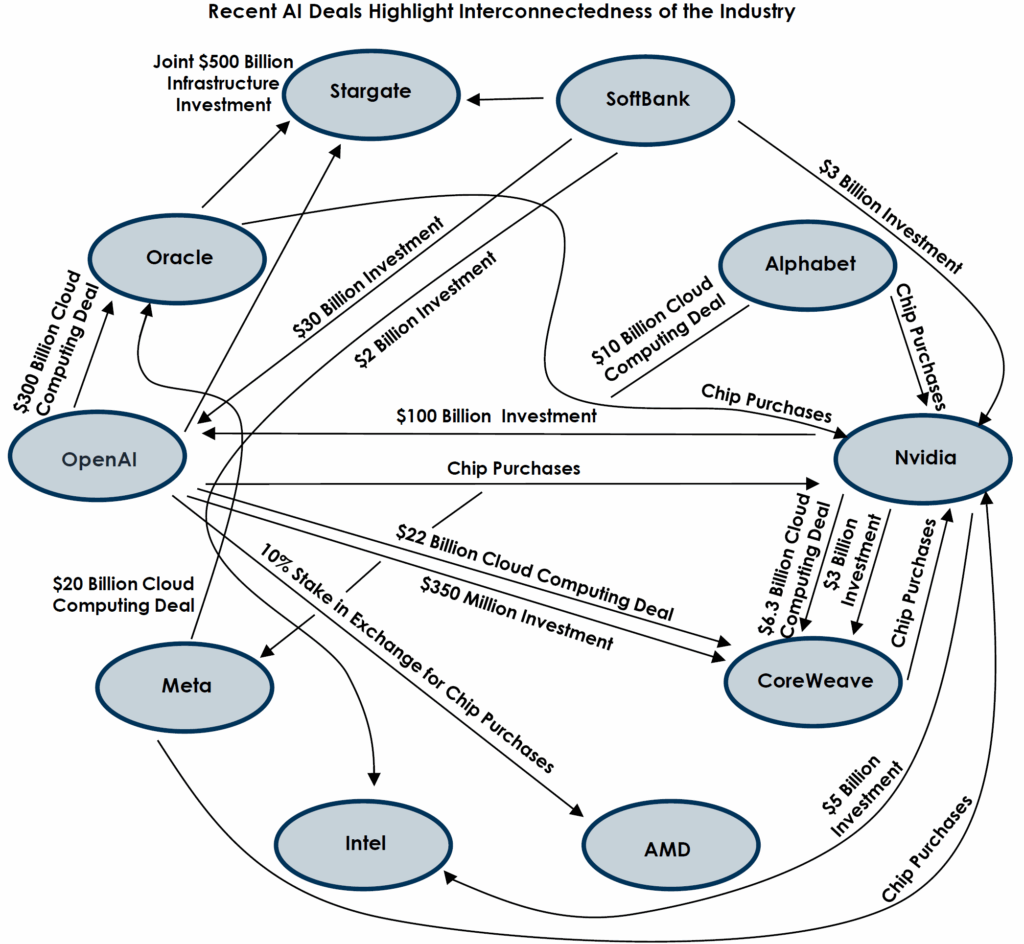

We would be remiss, however, not to reflect on the lessons from the dot-com past. The first being that early movers aren’t automatically the long-term winners. Before Google, there was Lycos, Excite, Ask Jeeves, Alta Vista, and Yahoo to name a few. While the hyper-scalers of today, Microsoft, Google, Meta, and Amazon, have clear advantages, they are also shouldering a significant amount of the infrastructure build-out. The costs are astronomical. This recent article by Yahoo Finance projects that Amazon, Alphabet (Google), Microsoft, and Meta will spend $364 billion in 2025 on AI buildouts. To put that number into perspective, that amounts to approximately 1.25% of US GDP and represents over 20% of the top-line revenues for those companies. In addition, there is systemic risk due to the concentration of parties involved in this buildout. The illustration below from our partners at Asset Consulting Group reflects the spaghetti bowl nature of the counterparty exposures.

To put one final emphasis on this point, the quote below is from one of our favorite reads: Michael Cembalest’s Eye on the Market.

“Oracle’s stock jumped 25% after being promised $60 billion a year from OpenAI, an amount of money that OpenAI doesn’t earn yet, to provide cloud computing facilities that Oracle hasn’t built yet, and which will require 4.5 GW of power (the equivalent of 2.25 Hoover Dams or four nuclear plants), as well as increased borrowing by Oracle whose debt-to-equity ratio is already 500% compared to 50% for Amazon, 30% for Microsoft and even less at Meta and Google.”

Ultimately, we remain optimistic about the growth and innovation that is yet to come, thanks to AI. We are, however, concerned with the near-term capital expenditure arms race that is taking place without being grounded in what a realistic ROI will be on these investments. Again, not to oversimplify with the comparison to the dot-com era, but we are not so far removed from the telecom bankruptcies of the early 2000s that we should be reminded that capital expenditures need to be balanced with financial prudence and execution.

The Macro Backdrop: Gradually Descending

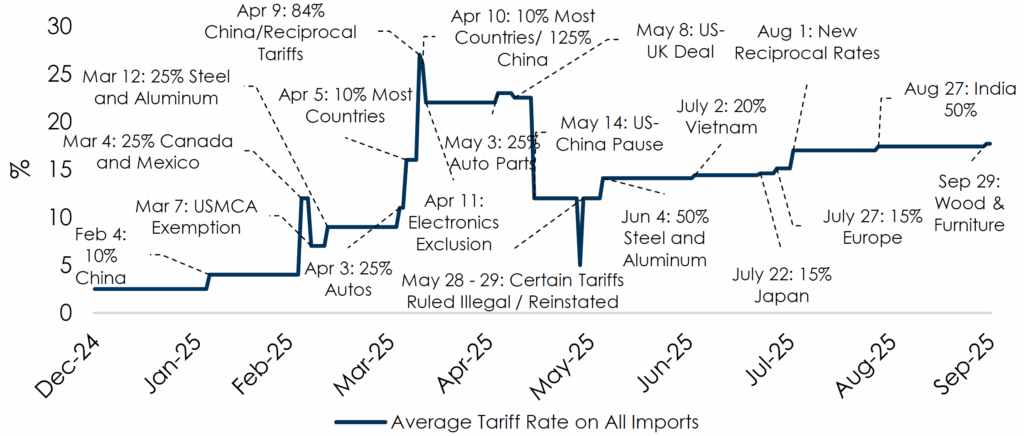

It is true that uncertainty is a way of life for investors. It is also true that the days surrounding “Liberation Day” were among some of the more chaotic in recent memory, as it represented one of the most dramatic challenges to the existing global trade system. Over the course of the last two quarters, we would argue that, with a few notable exceptions such as the recent tariff skirmish with China over rare earths, the framework of the global trade system has been taking shape.

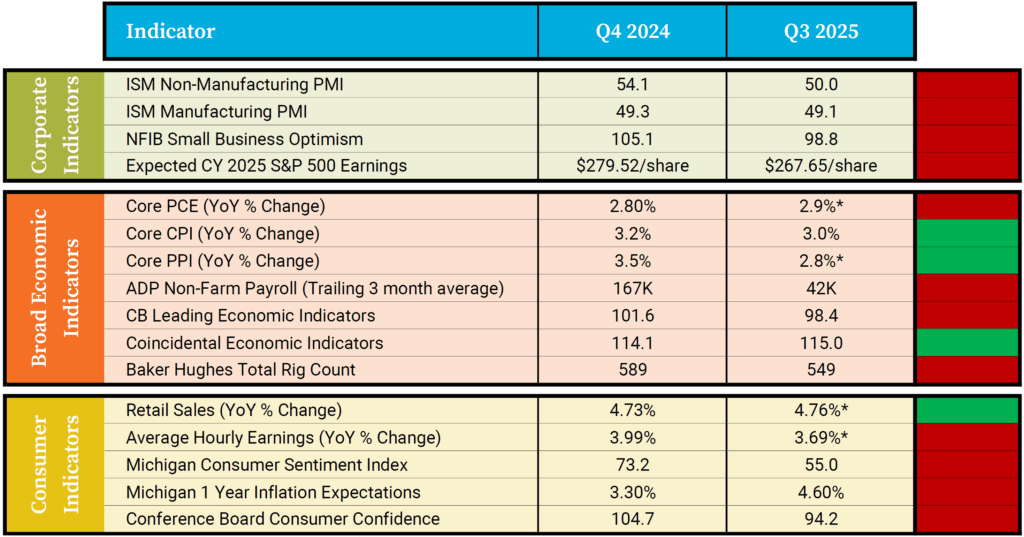

As the chart above illustrates, while tariff rates are still evolving, the violent swings from this spring have subsided. Stability aside, the reality is that tariff rates are still materially higher than they were at the beginning of the year, and we would have to go back almost 90 years to find a period during which tariff rates were this high. The economic impact has not been negligible. Below is a table comparing key economic indicators that we monitor over time.

While there are a few areas of improvement, such as modest progress on inflation providing the Fed the rationale to cut interest rates, overall the economic picture has deteriorated throughout the year. This article published by Yale faculty members indicates that infrastructure spending on AI is in fact masking a weaker economy. While overly conclusive estimates are generally illusions, the takeaway from our perspective is that the disconnect between economic reality and market pricing seems relatively broad, and we would advocate for a disciplined approach to rebalancing. Further, investors with known or probable cash flows in the next 12 months should be happy being paid current values for their investments.

Portfolio Implications

Calling a short-term correction is a fool’s errand. Being prepared for one, however, is not. To that end, investors can prepare in a few different ways, most notably with awareness and planning. Below is how those perspectives could shape up relative to the three major asset classes in which we invest: fixed income, equities, and real assets.

Fixed Income

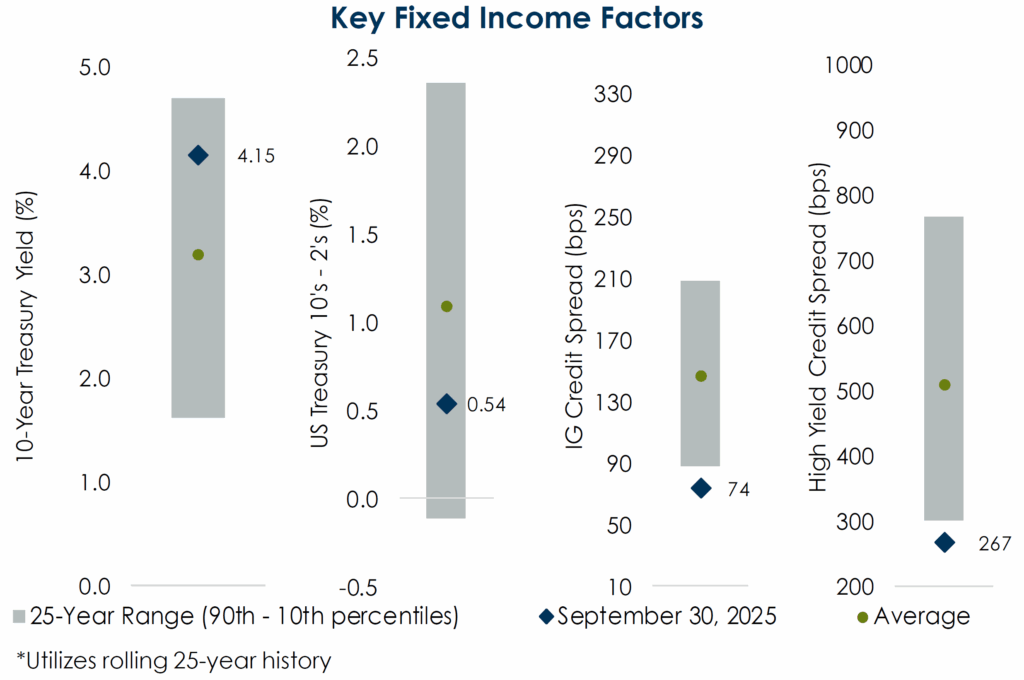

With the Fed making progress, albeit slowly, on inflation, interest rate cuts have driven yields down across the yield curve. The Barclays US Aggregate Bond Index is up over 7% year to date through last week, as declining interest rates have driven prices higher. As the chart below also highlights, spreads between treasuries and both corporate investment grade as well as corporate high-yield bonds have narrowed significantly since the beginning of the year.

The contrast between a slowing economic period, part of the justification for Fed rate cuts, and the current yield spreads highlights the needle that fixed income investors are having to thread, a challenge that will likely persist. A low spread doesn’t necessarily dictate future underperformance, yet it does put added importance on the degree to which potential credit losses are accounted for.

We view the overall bond market as being expensive and are being selective about the exposures that we are targeting. The market for private credit has grown substantially, and while we believe there are opportunities to increase overall yield in that space, we are biased toward maintaining a senior and secured position in the capital structure. In addition, we have been exploring opportunities to expand mandates within municipal bond strategies to allow for some extension into higher-yielding municipal bonds. These bonds come with added risks, as liquidity is more volatile, as can be the daily pricing. With Apollo’s Chief Economist, Torsten Slok, reporting that almost 90% of public fixed income yields below 5%, and inflation not yet conquered, we believe finding differentiated sources of yield will be additive for clients who rely on their portfolios for lifestyle needs.

Equities

While AI hype has contributed to the irrational exuberance of the equity market, as the table below highlights, valuations are expensive across almost every sector of the S&P 500.

At these valuation premiums, we are willing to recommend some profit-taking in US large-cap equities, despite the probable tax implications of trimming what has been the best-performing asset class over the last decade. We are not advocating for any major reductions in exposure, but rather some pruning of allocations that in most cases have grown to be overweight. Small companies, as measured by the Russell 2000 Index, are also expensive relative to historical norms and could be a secondary source of liquidity. Emerging Markets can also be used for selective liquidity purposes as the correlation to US large-cap and the AI theme are elevated due to the concentration in names like Taiwan Semiconductor, Tencent, Samsung Electronics, and SK Hynix. Recalling the quote by Keynes, we recognize that by trimming equities, we might be leaving some growth on the table. However, at current values, we can hardly say we are getting a bad deal.

On the private equity side, liquidity markets have been reopening, and as the chart below indicates, transaction volumes are recovering.

We continue to look for and identify select investments across venture capital, lower middle market, and buyout stage funds. We view these as opportunities to identify and own great businesses without the excessive noise of the public markets. In essence, these represent strategies whose time horizon pairs well with the families we serve.

Real Assets

The real estate market remains one of the few areas of the markets where we believe that values reflect a rational view of reality. Similar to equity markets, AI-related investments are exploding.

As the chart above highlights, data center investing has exploded. Vacancy rates remain extremely low, and unsurprisingly, we are seeing managers put capital behind these kinds of projects. Our opinion remains that real estate investing represents an alpha-dependent market. In other words, while declining interest rates are a general tailwind, a slowing economy leads to disparities among property types and metro regions, which leads us to favor a selective approach.

Conclusion

Our outlook is one of caution and discipline. The relentlessness of the current bull market seems to be bordering on irrationality. We therefore have to balance the cost of being early with the risk of near-term volatility creating inopportune moments of needed liquidity. As such, we are advocating for measured risk management, one that looks forward at the factors that are within our control such as cash flow needs and tax tolerance and prepares for the factors that are outside of our control.

About Thierry J.D. Brunel

Thierry joined Matter in 2013, bringing years of experience in family office and wealth management. He previously worked in investment research and portfolio management roles at Convergent Wealth Advisors and GenSpring Family Office. At Matter, Thierry leads the investment committee, advising families on portfolio strategy and governance. A Wake Forest University graduate, Thierry has a diverse international background. He’s active in his community, serving as an assistant coach for the John Burroughs School Varsity football team in St. Louis.

Other Blogs by Thierry

This report is the work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.