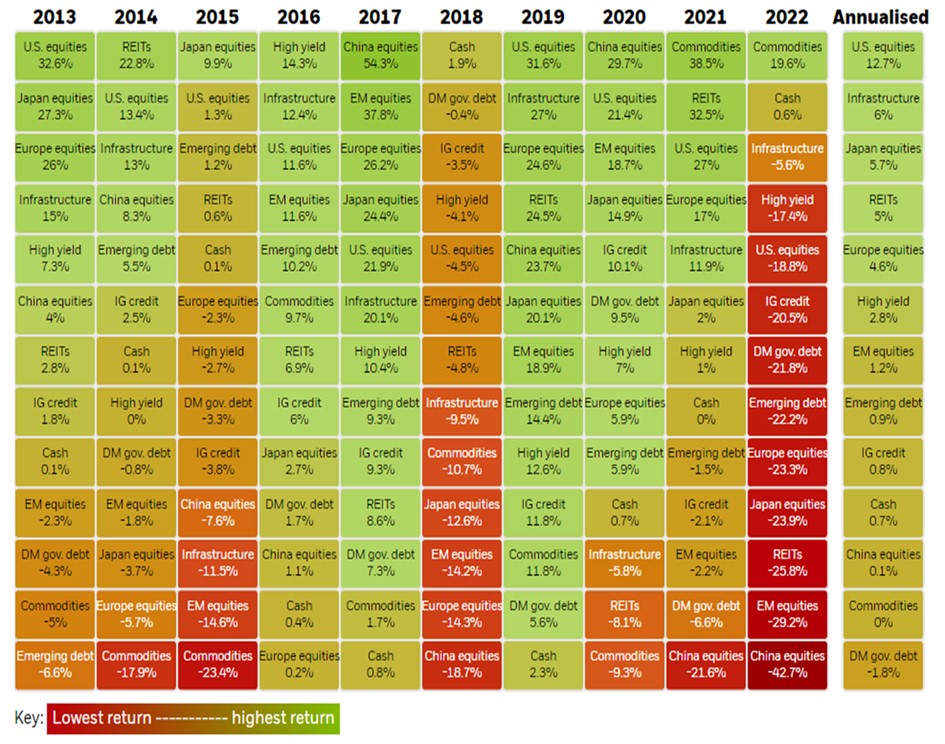

There has been a lot for investors to digest throughout this year—the war in Ukraine, persistently high inflation, one of the fastest rate hiking cycles in history and the residual impact of a globally disjointed COVID response and reopening policy. The result has been broad-based asset class declines, in which—as the chart below highlights—only commodities and cash have been spared.

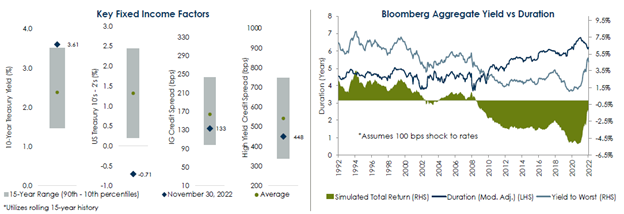

The magnitude and the breadth of the decline stand out when viewed through the context of the last decade. In addition, one of the more unique nuances is how significant the declines have been across fixed income and how the main driver has been exposure to interest rate risk, as opposed to concerns over a deterioration in credit conditions. This has two important implications. The first is retrospective and highlights the degree to which typical portfolio protection—i.e. high quality bonds being a portfolio ballast in market corrections—has not worked this year. The second is prospective, which is that while yields across all fixed income markets have increased, and now provide reasonably attractive forward looking returns, some caution is warranted in the higher yielding space, as the spread relative to high quality bonds is still well below the historical average. More on that when we dive into portfolio implications.

A Few Hundred Words on Inflation…

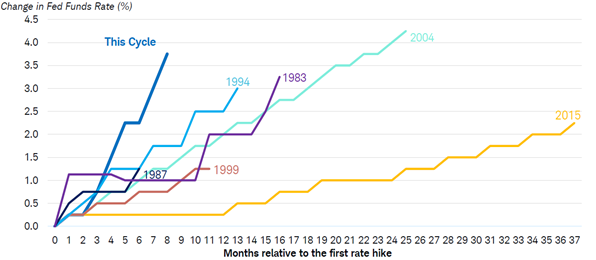

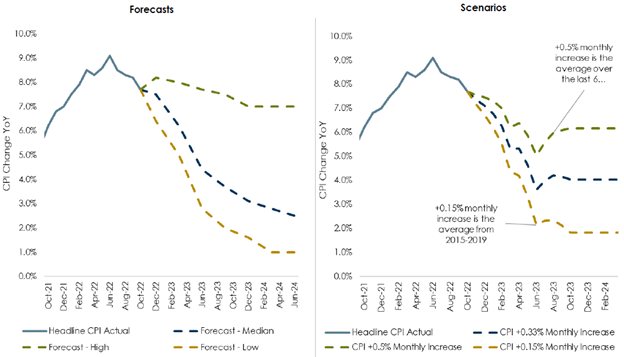

Most of our managers agree that the key variable over the next 12-18 months will be the degree to which inflation comes under control. Predictably, the forecasts are divided, though as the charts below illustrate, the consensus seems to be that the Fed’s aggressive rate hiking program (chart on top) is leading economists to believe that inflation will come down meaningfully in the next 12 months, though still remain above the Fed’s stated 2% target (chart on bottom).

The Fed is facing huge challenges. One is credibility as it was less than 12 months ago when many Fed participants labeled inflation as transitory. Another is implementation as they attempt to guide an obviously imbalanced economy into a soft landing.

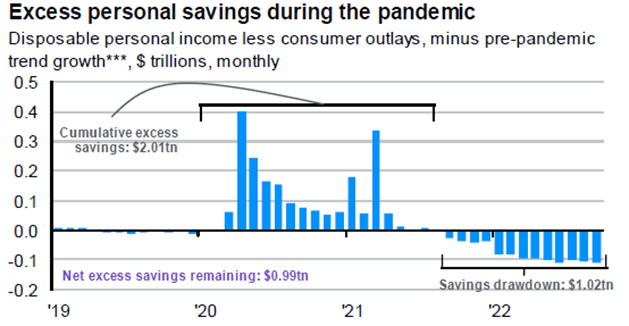

On the nature of the imbalance, all you have to do is look at the conflicting trends within the underlying contributors to inflation. Commodity prices have, by and large, turned over, as have inputs like transportation and various goods (used cars, apparel). On the other hand, housing and services remain stubbornly high, supported in part by a US consumer that, as the chart below illustrates, is working through the excess savings that were built up during the pandemic.

The bottom line is that it seems highly unlikely that the Fed can engineer the required slow-down in inflation without seeing a corresponding rise in unemployment. To put that challenge into perspective, according to the Bureau of Labor Statistic, the current size of the civilian labor force in the US is just over 164 million, whereas total civilian employment (people with jobs) plus job openings equals 168 million. In other words, there is a 4 million person gap between the jobs we need to fill and the people we have to fill them. So it is easy to see why many of the companies in which our managers invest are saying that finding labor and/or paying wages that can attract said labor is one of the biggest challenges they are facing in today’s environment.

Asset Class and Portfolio Implications

Inflation and many other macro factors will have an impact on the returns generated by any investment in the near run, but the key is striking the balance of having a perspective on the near-term, without allowing it to drown out the case for holding those investments for the long-term. It’s always a challenge, but never more so than when market sentiment reaches its extremes (either bullish or bearish). To that end, we wanted to outline some of the key considerations and guidance for the key investment buckets in our portfolios (cash, fixed income, equities and real assets).

Cash

It is a bit of a stretch to refer to cash as an investment, but decisions made regarding when and how much cash to hold do impact the capital available for investment in the rest of the portfolio. Over the last 12-18 months, we have been advocating for conservative liquidity planning that would imply that investors should be holding 12+ months of cash flow needs in cash. We continue to believe that holding known liquidity needs in cash makes sense, though given the additional yields we are seeing in fixed income and money market funds, we’d be comfortable planning for the next 6-12 months as opposed to the next 12+ months.

Fixed Income

We read a lot of market commentators but one of my favorite reads has been and continues to be Howard Marks of Oaktree Capital. His most recent piece (linked here for those who would like the read) highlights an important shift in the investment landscape—bonds are finally providing a reasonable level of return potential.

While real yields are still by and large negative, if you assume that the Fed will accomplish its goal of reducing inflation over the course of the next 12-18 months, selectively buying back into the bond market seems like a good course of action. Credit spreads and default rates are still below historical norms—and well below levels that imply an imminent recession—an environment that is shaping up to provide good credit analysts and patient investors with good long-term return opportunities. Commentaries by our managers would reinforce that perspective—while they are not rushing back in, they are actively looking and willing to step into the high yield market for the right fundamentals.

Equities

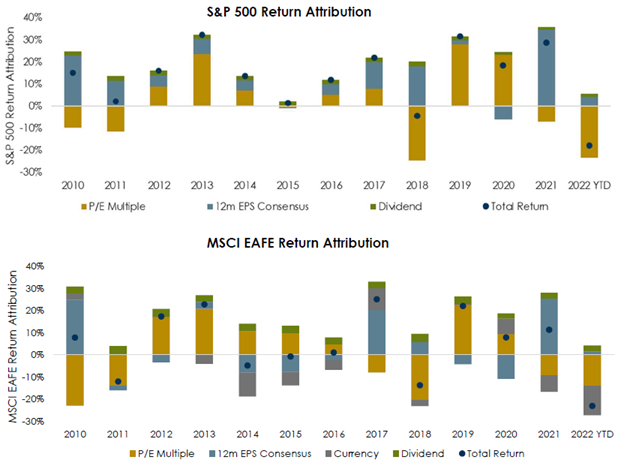

We have admittedly been surprised by the resilience of corporate earnings this year. While earnings growth has not achieved the levels anticipated at the beginning of this year, profits have not declined as would be more typical of a recessionary environment. As the chart below reflects, across both the US and Non-US stocks, the losses in equity portfolios have been driven by a contraction of equity multiples (and currency declines for Non-US stocks).

Across our equity portfolios, managers are taking varying approaches—though themes among styles are starting to emerge. Growth-oriented managers are generally sticking with their positions, though having a slight bias towards defensive growth as opposed to aggressive growth. Value managers, on the other hand, are starting to take a closer look at some deeper value opportunities. Overall, we remain neutral—valuations are reasonable, but the murky economic outlook warrants caution and restraint. For those looking for additional buying opportunities, we think rebalancing to strategic targets always makes sense, as does a disciplined commitment plan to private equity.

Real Estate

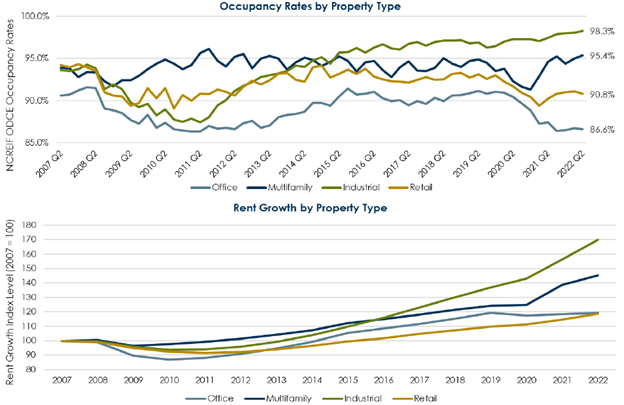

The returns in real estate have essentially been bifurcated: private REITs have proven resilient throughout the year, whereas publicly traded REITs have sold off with every other liquid asset class. While we are starting to see cracks form in the private real estate space, with Blackstone needing to cut back redemptions in its semi-liquid real estate fund BREIT, the outlook is not all doom and gloom. As the chart below illustrates, occupancy rates and rent growth have remained relatively steady. One outlier has been office space. Rental income has plateaued, and occupancy rates have not recovered to pre-pandemic levels. That being said, we are careful not to write-off the entire category of office real estate, as well-located quality buildings have still generated attractive NOI growth and competitive occupancy levels to date.

Due to the rise in interest rates, previous cap rates (which are calculated by dividing net operating income by market value) are now below the cost of debt financing, for which there are only two potential solutions. The first is that values stay the same, but net operating incomes increase therefore resulting in cap rates that are equal to or higher than the cost of debt financing. The second is that values decline. Of course there is a third, which is that cost of debt declines, but that seems unlikely given the inflationary and recessionary headwinds. Our guidance continues to be to take steps to rebalance real estate allocations that have grown outside tolerance, but to do so at a moderate pace as we do not want to be sellers into a low volume market.

As you’d expect, every asset class comes with its share of risks and opportunities. So, no surprise that our approach is disciplined and balanced. Our job is to provide the best assessment of the environment and guide clients to making the best decisions for their family in the long run. This requires us to resist making major calls on the near-term direction of the markets. At the end of 2021, the range of predictions of where the S&P 500 Index would end 2022 was between 5,300 and 4,400. As of today, the S&P was below 3,800. The bottom line is that there are just too many unknowns to reconcile in the near-term. While we certainly use a reasonable, but humble, evaluation of current factors to allow for some modest tilts within portfolios, we think that long-term strategic asset allocation and disciplined rebalancing are the keys to achieving long-term goals.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.