At one point in April, Business Insider estimated that a third of the world’s population was under some form of lockdown or shelter in place order. Now, as restrictions are being lifted and we are allowed to resume some semblance of normal life, we are faced with the uncertainty of what comes next. The answer to that question relies heavily on the world’s ability to manage COVID-19—a prediction which we are incapable of providing. However, understanding where we are currently helps us to remain strategic in our long-term outlook while allowing us to also acknowledge, and plan for, our short-term reality.

The Jobs Lever

From an economic standpoint, we are faced with the question of when and how quickly the economy can rebound. The unemployment information released by the Bureau of Labor Statistics on Friday, May 8th points to a level of unemployment and job losses not seen since the Great Depression. How quickly can we recover the jobs that have been lost? Based on the Nonfarm Employment Data tracked by the Federal Reserve, in the post WWII era, it has taken the economy an average of 30 months to recover jobs lost during a downturn. However, there is no precedent for the current driver of job losses—a medical crisis that has resulted in a full economic shutdown. Optimistically, based on the responses to the Bureau of Labor Statistics employment situation survey, 85% of the 20.5 million people who lost their jobs in April indicated that their layoff was temporary. Whether that hope proves warranted or not is a major unknown and hinges almost entirely on our ability to live with or manage through a world with COVID-19.

A Tale of Two Equity Markets

The equity markets have seemingly experienced a full cycle in a matter of months. In February and March, as the world grappled with the likelihood of broad–based economic shutdowns, equity markets underwent a material revaluation. According to Yardeni Research, the consensus 2020 estimates for the S&P 500 earnings are $128.02 per share. On March 23rd, the S&P 500 Index hit an intraday low of $2,192, implying that at the market low we were paying a forward multiple of 17.1x, which is only modestly over the historical average. Since then the S&P 500 has rallied slightly over 28%, and forward multiples, based on consensus 2020 earnings, are 22x—a rich premium if all we consider is the outlook for earnings this year. However, some will argue that 2020 is an anomalous year and that there will be a material snapback in 2021. According to Yardeni Research, the consensus estimate for earnings in 2021 are $166.03, implying a growth of just under 30% year-over-year between 2020 and 2021—which would make it the best year for earnings growth since 2010. If we look forward to 2021 and use the consensus estimates, the market is trading at 16.9x forward earnings—which is a reasonable level, though some discount should be applied to account for the added risk to earnings that are forecasted 2 years out.

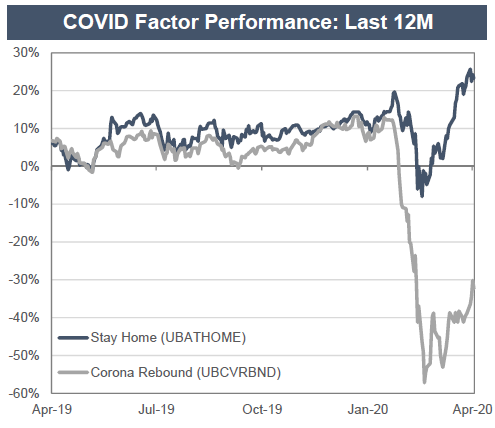

Another interesting wrinkle in the equity market picture is the continued divergence between Growth and Value, both on the downside and then on the upside. Sectors that are typically considered growth sectors—Technology and Healthcare for example (which make up over 50% of the Russell 1000 Growth Index) were down about two-thirds of the overall YTD market decline through March, but subsequently captured between 95% and 110% of the rebound of the S&P 500 in April. Conversely, sectors that are typically considered value sectors—Financials and Industrials for example (which make up a little over 30% of the Russell 1000 Value Index) were down around one and half times that of the market, but have only fractionally participated in the recovery in April. The chart below was put together by ABS Investment Management and points to some of the unique factors at play. The Stay Home basket of stocks represents companies that are seen as being resilient or even benefitting from the shelter in place order—examples of which would be companies in the e-commerce supply chain (Amazon, eBay, Fedex, UPS), technology services businesses (Alphabet, Netflix, Spotify, Zoom) or more traditional consumer staples (Costco, Clorox, Kroger). The Corona Rebound bucket represents the companies that are more reliant on an open economy and a resumption of “normal” consumption patterns—examples being hospitality (Hyatt, Hilton, Wynn Resorts), airlines (Delta, Southwest, United) and food services (Yum Brands, Starbucks, Shake Shack). In our opinion, the participation of the Stay Home basket in the recovery points to a market that has not yet concluded that the world is free and clear of COVID-19.

Bond Investors Remaining Wary

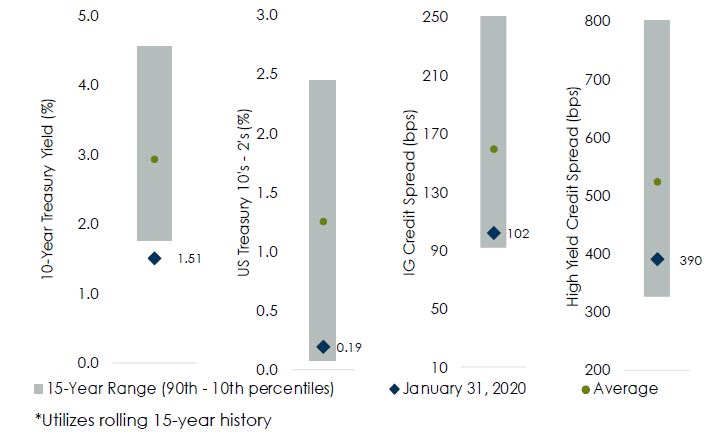

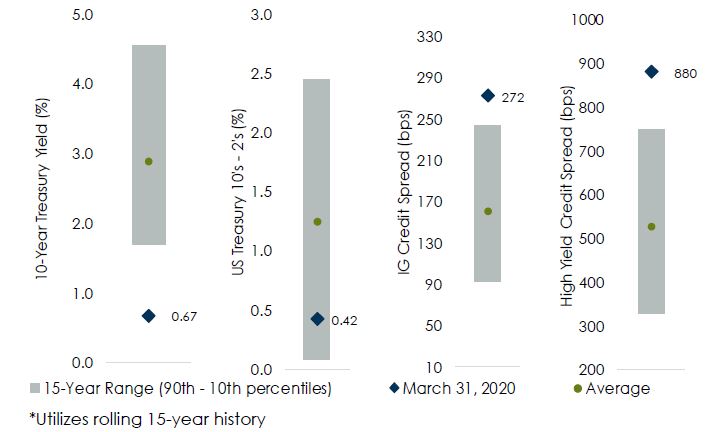

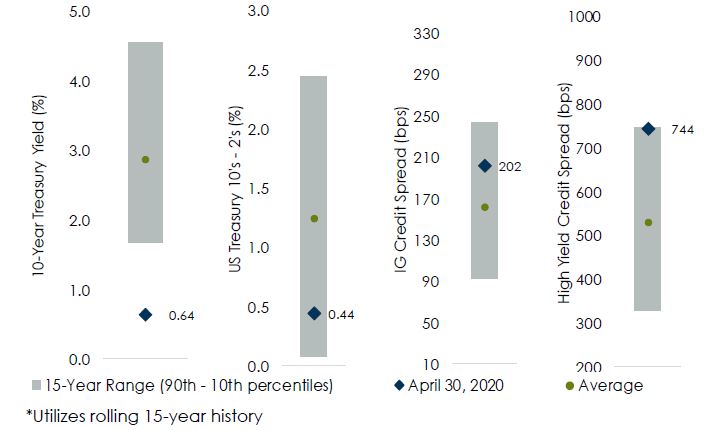

Bond markets are signaling a similarly cautious tone. March was a historic month for the bond markets as investors prioritized liquidity over any other metric and sought refuge in US Treasuries. The charts below illustrate fixed income valuations at three different periods of time—interestingly all of them happened in the first 4 months of 2020.

Key Fixed Income Factors as of Jan 31, 2020

Key Fixed Income Factors as of March 31st, 2020

Key Fixed Income Factors as of April 30th, 2020

In reviewing these charts, we realize that just like equity markets, bond markets have explored different ends of their valuation spectrums in the last five months. However, as the data as of April 30th, 2020 indicates, bond investors are far from signaling the all–clear. While spreads between Treasuries and both Investment Grade Bonds or High Yield Bonds have narrowed since their peaks in March, they are still well above their 15–year averages.

Acknowledging Uncertainty

In his latest memo, Oaktree’s Howard Marks dedicates the bulk of his comments to the notion that we are incapable of knowing the future. It’s a particularly enjoyable read for those who have the time. Ultimately, Matter’s approach to managing through this pandemic has been moderate and disciplined. As we have in the past, we continue to advocate raising cash for known lifestyle needs, while staying within the constructs of our long-term strategic targets. On the margin, however, the fund managers with whom we invest have been making adjustments below the surface, some of which we outlined in a blog post a few weeks ago. Our investment committee continues to challenge our long-term assumptions, but simultaneously we have to respect the uncertainty of the situation in the near term. In addition, while much of what we have experienced thus far has limited precedent, the measurable results in the capital markets have remained within the range of long-term expectations.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.