The world is an uncertain place—it always has been and always will be. The recent past is a perfect reflection of that reality—a global pandemic, multiple military conflicts, monetary policy shocks, natural disasters, and the list could go on. Yet the power of human ingenuity and the resilience it has helped develop means that we are constantly improving the way in which we face these dynamic challenges. In a period of time when optimism seems scarce and criticism and concerns appear abundant, we are optimistic about an investment theme anchored on scalable innovation and a deliberate transition to a more sustainable future.

So what does that mean? We believe that the increasing global demand and global awareness surrounding sustainable and efficient energy and resource practices are driving (and will continue to drive) future capital flows. Population growth, climate change and evolving consumption patterns support the need for the development and scaling of both existing and novel businesses and technologies. Three key areas that we believe could offer interesting investment opportunities are: Energy Transition, Real Estate Technology (“PropTech”) and Agricultural Technology (“Ag Tech”). Importantly, we believe we are nearing, or in some cases arrived at, the intersection between scalability, profitability and sustainability. The growing momentum behind net zero commitments has created, in our opinion, a compelling investment trend for long-term investors.

The Net-Zero Push

The concept of net-zero is not new. It traces its origins back over 30 years to the adoption of the United Nations Framework Convention on Climate Change, which defined net zero as “a state in which human activities emit no more greenhouse gases than can be removed from the atmosphere over a comparable time period.” While the concept is not new, the momentum behind it has been building over the last decade. The United Nations’ Race to Zero Campaign has built an alliance of over 8,000 companies and over 1,000 cities that are committed to achieving net zero carbon emissions by 2050. Net Zero Tracker, estimates that over 150 countries and almost 1,000 businesses, representing over 90% of global GDP, have established or proposed net zero targets.

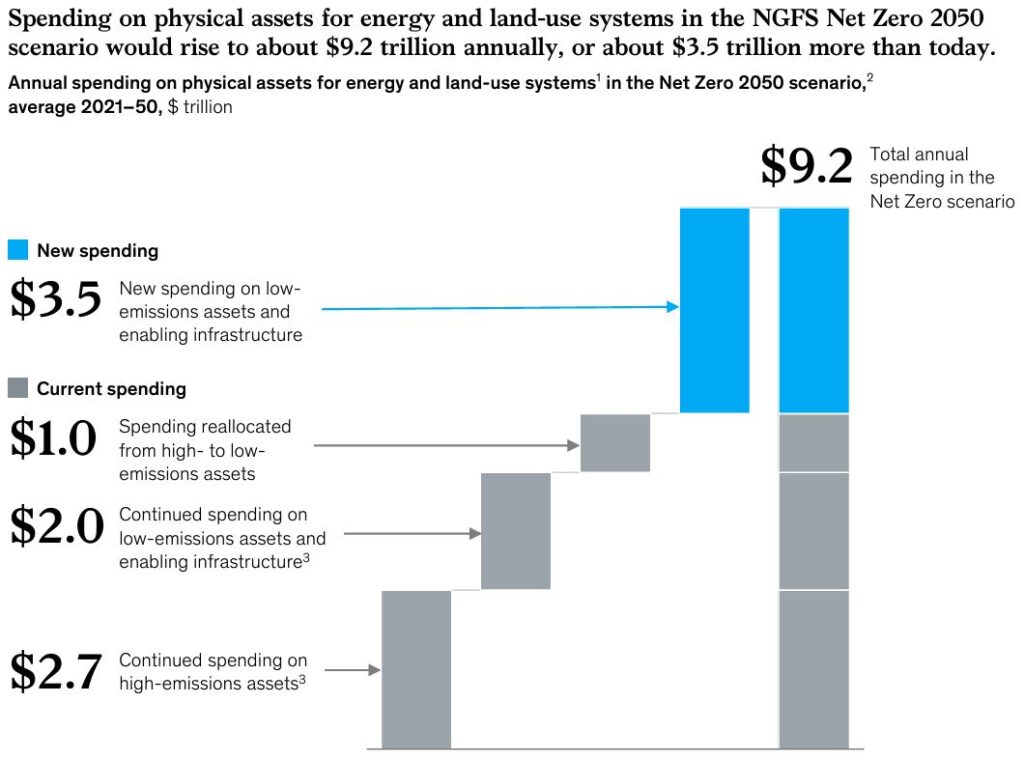

Simply put, the scale of the required transition is massive. While any forecast is going to have its share of limitations, McKinsey is among many of the consulting firms that have done research trying to quantify the investments required to achieve net zero by 2050. The chart below is from a 2022 research report entitled “The Net Zero Transition: What It Would Cost and What Could it Bring.” By their estimate, McKinsey believes that the transition will require investments totaling $275T over the next thirty years. This equates to approximately $9.2T per year, of which $3.5T would be incremental new spending.

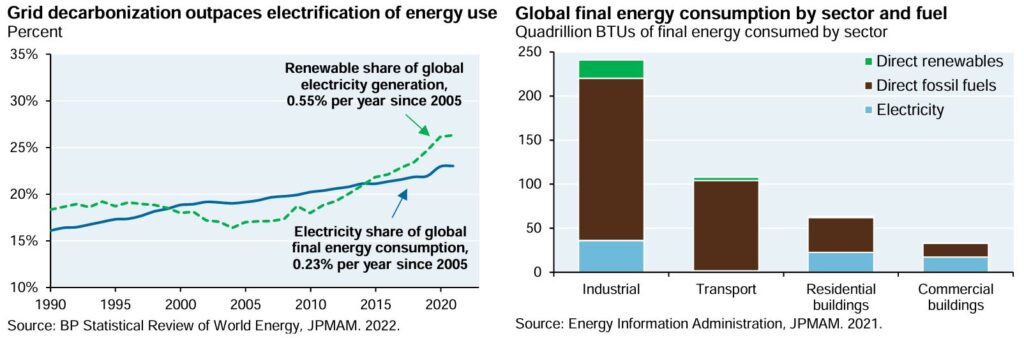

In practice, however, the path will likely be bumpy. Accenture recently published its research report entitled “Destination Net Zero” and the contrast between commitment and reality is stark. According to the report, while 37% of the world’s largest companies (defined as the top 2,000 public and private companies) are committed to net zero, less than 20% are actually on track to reach net zero by 2050. It’s a sobering and critical reminder of the complexity of the transition and both the known and unknown costs of doing so. Michael Cembalest, JP Morgan’s Chief Strategist, has written an annual energy paper for the last 13 years and his most recent report highlights the relative adolescence of renewable energy and both the growth opportunities as well as limitations. The chart below does a great job of illustrating the nuances of how far we have come and yet how far we still have to go.

Since 2010, renewable energy’s share of global electricity has grown from about 17% to 26% (chart on left), yet the highest consumers of energy are still predominantly reliant on fossil fuels (chart on right). Said another way, we have made strides in generating cleaner electricity, but electrification still has a lot of work to do to displace fossil fuels as the key energy input. This reality requires us to prioritize pragmatism over aspiration. We don’t believe that we will be able to solve all of the world’s sustainability and climate-oriented challenges at once, but we do believe that we can make incremental gains that will compound over time.

Where Are We Focused?

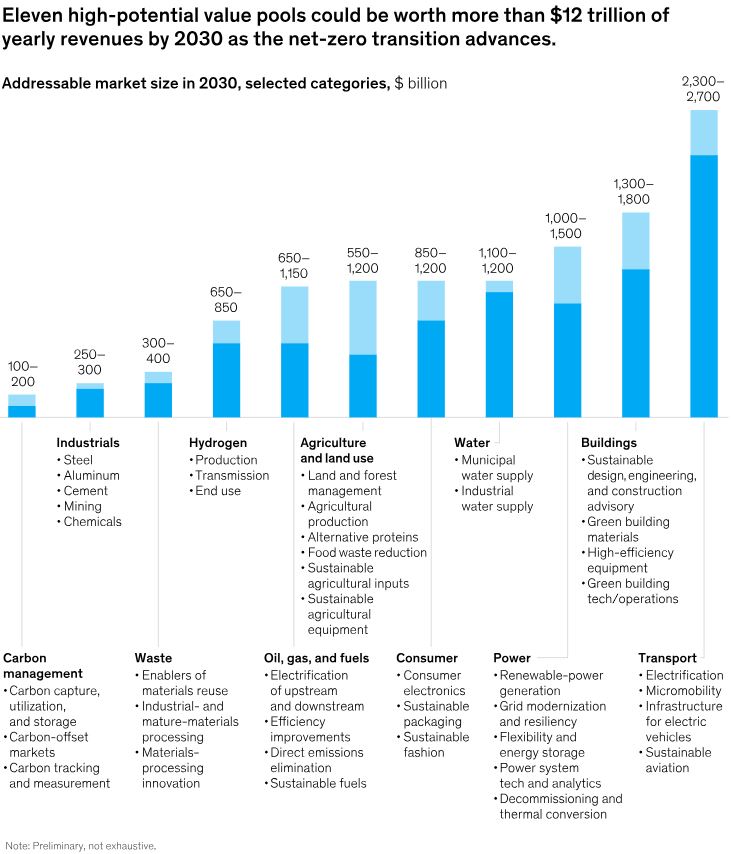

With such an audacious goal, the question we inevitably ask ourselves is: where do we begin? First, we are long-term optimists and believe in the power of human innovation and are confident that new and revolutionary technologies and practices will be developed over the next three decades. Having said that, a focal point of our investment theme rests on the concept of scalability and so we are focused on three key areas: Energy Transition, PropTech and AgTech. We believe these three segments cover some of the largest investment and growth opportunities. The chart below comes from a McKinsey research report entitled “Building green businesses to speed the transition to net zero”, where they identify eleven sub-markets that represent approximately $12T of potential annual revenues.

We believe this creates a compelling backdrop from which to identify attractive private equity investments, with our initial focus being on the three segments outlined below:

Energy Transition

The shift from high-carbon hydrocarbon-based energy to lower-carbon alternatives, including renewables and cleaner fossil fuels presents investment opportunities in companies and supportive infrastructure to enable the delivery of a more diversified energy supply chain. While this represents a very broad opportunity set, some more specific areas that we believe are in focus would be the construction of utility scale renewable power projects, electrification of transport and the infrastructure that facilitates the transmission and storage of a more diversified energy grid. According to the International Energy Agency, over half of global electricity is currently generated using oil, natural gas and coal. In order to achieve net-zero emissions by 2050, capacity in wind, solar, nuclear and hydropower will need to be expanded in order to replace the incumbent fossil fuel generation capacity. This diversity adds to the resilience of the overall economic ecosystem, which we view as an important benefit in an increasingly multi-polar geopolitical world. Deal flow within this theme is proving to be robust, for example, Blackstone is currently reviewing $5.7B of potential energy transition deals. Importantly, valuations across this space have also moderated, creating a more attractive buying opportunity, particularly in later stage deals as valuations for Series C and D financing of US and EU cleantech companies have declined between 30-45% from their peak. We believe this confluence of demand, financial feasibility and reasonable pricing creates the backdrop of a compelling investment opportunity.

PropTech

According the United Nation’s 2022 Global Status Report for Buildings and Construction, buildings account for approximately 37% of global CO2 emissions. Yet, despite this critical role, investments to date have been modest. Momentum is growing, however, spurred by a combination of policy tailwinds as well as cost compression. The Inflation Reduction Act (“IRA”) in the US, the EU Green Deal are two examples of regulatory policy that are creating tailwinds for the broader prop tech space, providing tailwinds for clean building materials, home efficiency upgrades and green hydrogen production among others. Additionally, cost compression, particularly in solar energy, is further incentivizing investments across the multi-family residential and industrial segments of the real estate markets. Galvanize, a firm founded by Tom Steyer and Katie Hall, has launched a strategy specifically targeting the decarbonization of multi-family residential, industrial, student housing and self-storage buildings. Given the importance of the built environment’s role in the transition to net zero, we believe it creates attractive investment opportunities. We believe the decarbonization of buildings—from renewable power generation or an evolving role within the grid or investments in energy efficient heat pumps and appliances—is a trend that makes as much financial sense as it does environmentally.

AgTech

The increasing global population and the demand for scalable sustainable farming practices requires innovative agricultural practices, creating investment opportunities in precision farming and AI driven crop management along with food and water supply safety. According to the United Nation’s Food and Agriculture Organization’s 2021 report, agriculture is responsible for 70% of the world’s freshwater withdrawals. Unfortunately, the equation between the food required to feed the world’s growing population and the resources required to produce that food will not balance without increasing agricultural productivity and resource efficiency. According to Pitchbook, the number of early-stage financings in AgTech have increased 10x since 2010, a significant portion of which have occurred in the last 3 years. Unsurprisingly, this resulted in some high valuations which have moderated over the last 18 months. We believe that the secular trend remains in place, though are biased towards later stage businesses as we believe it will help mitigate the technology and valuation risks.

Implications on Investment Strategy

We believe the transition towards sustainability represents an attractive investment theme, though as always the manner in which we implement the strategy is critical. While the range of options is broad, we are choosing to focus on three key sub-thematic areas—Energy Transition, Prop Tech and Ag Tech. It is fair to say that this is a developing area of investment, therefore we believe that investors will be best served by taking a long-term and pragmatic point of view. In practice, this means avoiding the allure of taking too much new technology risk and instead focusing our energy on areas of the market that are slightly more mature and have proven scalability. We believe patience is warranted and therefore are prioritizing higher probability incremental impact over lower probability transformational impact. We are on a cruise ship, not a speed boat, and making changes will take time. Lastly, given the breadth of the opportunity set, we are also happy to take a diversified approach and allocate across a small portfolio of private equity funds. We are excited about the opportunity ahead. We believe that a private investment strategy, focused on our three key investment themes and guided by pragmatism will generate attractive returns for investors while contributing to the transition towards sustainability.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.