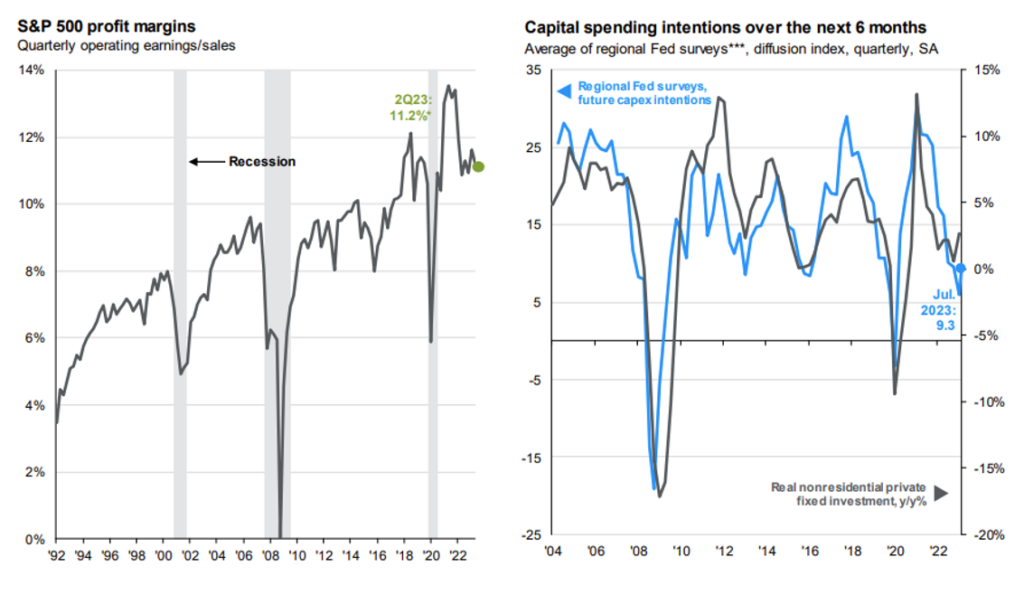

How should investors make sense of what is happening in the markets and what is happening across global economies? It’s admittedly THE million-dollar question. Short-term interest rates are the highest they’ve been since the global financial crisis in 2008/2009. As the two charts below illustrate, companies in the US are facing declining profit margins and are taking a cautious approach to future capital expenditures. Lastly, real estate markets across the US are having to contend with a financing market that has become both expensive—as a result of Fed policy—and less robust as many banks have pulled back on their lending portfolios.

Yet with all that gloom and doom, we have experienced a market rally that almost nobody saw coming. For the history majors among us, as of the end of last year, the average forecast across the 20 largest financial institutions in the US was for the S&P to end the year below 4,100. The market currently stands around 4,400. The most predicted recession in history has not materialized, despite numerous indicators to the contrary. Simply put, the economy has demonstrated a resilience that was unanticipated.

So where do we go from here? As always, every investment we make carries corresponding risks and opportunities. In the sections that follow, we’re going to endeavor to identify our perspectives on both and how we are guiding clients to position their portfolios accordingly.

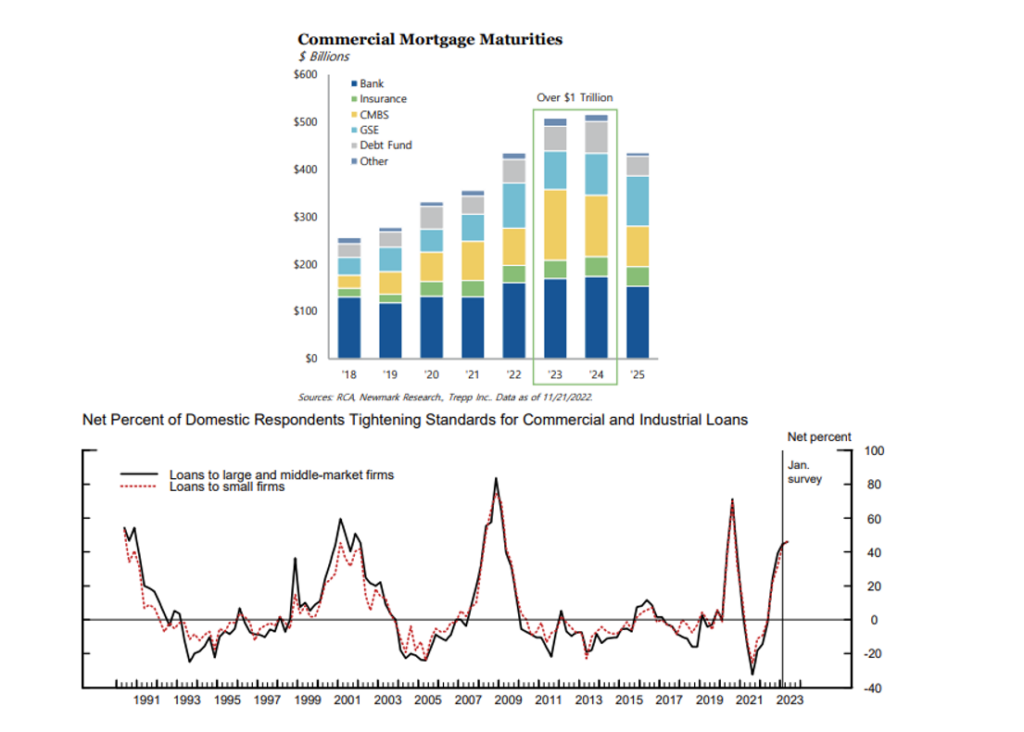

Rents, Vacancies, Lending and Maturities

The golden era of real estate came to a grinding halt in 2022 as the Fed embarked on its most rapid tightening cycle in history. As a result, we’ve seen the sharpest decline in transaction volumes since the global financial crisis. The current lending environment is further exacerbating the issue. As the two charts below highlight, not only is there a material amount of debt maturing in the next two years, but that debt is coming due as banks are proving less willing to extend credit.

The bottom line is that we have and are likely to continue to see selective distress. A word of caution regarding the headlines that will come across our newsfeeds: the details must be considered. For example, the headline of a recent article by the Wall Street Journal speaks to the perilous times ahead, specifically within the multi-family real estate market. Yet to be fair, the leverage factors referenced in the article (80% LTV or higher) point to highly speculative investment profiles—exactly the kind of investments that should face peril during a rapid swing in interest rates and risk appetite. With distress, however, comes opportunity and we are seeing some funds come to market to serve as providers of liquidity for forced sellers and possibly benefit from the situation. In addition, the cost of housing has been one of the stickiest components of inflation and therefore real estate owners are benefitting on the margin by higher rental income. Ultimately, time horizons matter. We believe long-term investors will be able to weather the near-term storm and may in fact have the chance to be opportunistic buyers as we work our way through this real estate cycle.

The Return of Yield

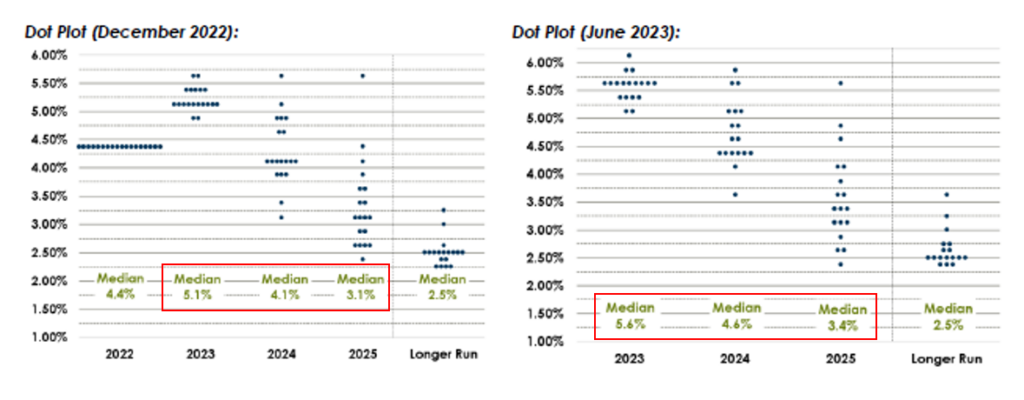

The persistence of inflation and the strength of the US economy have been a surprise to most market participants. Evidence of this can be found by comparing the market implied futures rates following the February Federal Open Market Committee meeting and the most recent meeting in July. According to CME Fed Watch, following the February meeting, the futures implied fed funds rate for September was 4.77%. Following the July meeting, that implied rate was 5.38% – meaning rate expectations moved up almost 75bps in less than six months. Further, a comparison of the Fed dot plot charts below highlights the degree to which expectations of where terminal rates might end up and how long they will stay there have changed since last year.

Given the progress made thus far on inflation, it is reasonable to believe that we are nearing the end of the rate hiking cycle. However, the demonstrated resilience of the economy thus far and the relative stubbornness of certain inflation factors lead us to believe that rates will likely have to remain higher for longer than what is currently being anticipated.

From an opportunity set perspective, we are content to stay at the higher end of the quality spectrum in fixed income. High yield spreads remain too narrow for us to extend credit risk too far and real yields in core bonds should improve as inflation comes down.

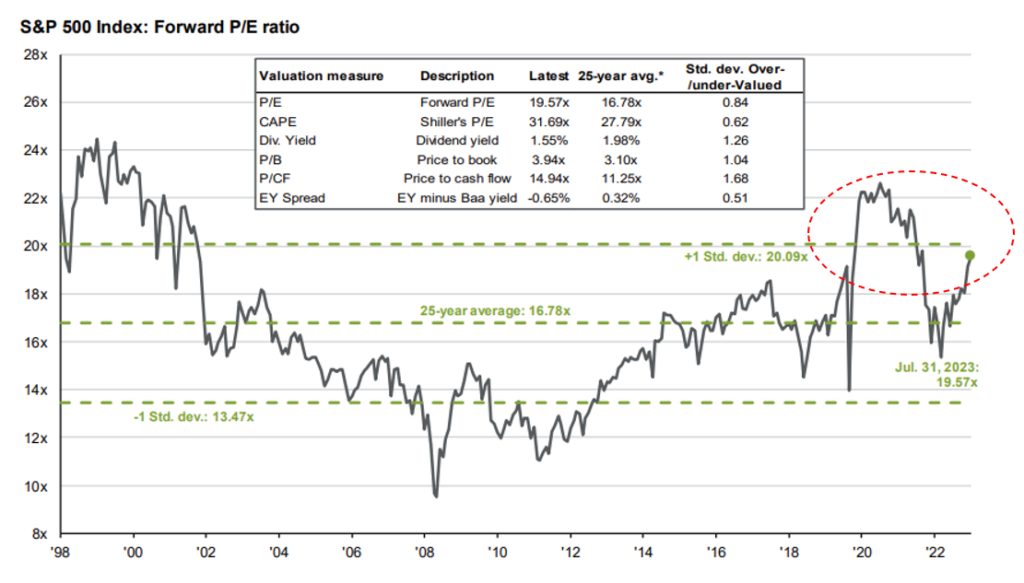

Expensive Multiples for Modest Earnings

According to Factset, with over 84% of the companies in the S&P 500 having reported, Q2 earnings are projected to have declined by 5.2% on a year-over-year basis. While this would be the worst decline in earnings since Q3 2020, it is in fact better than what we would have expected coming into the year given the prevailing risks. The challenge, however, is reflected in the chart below.

We are once again faced with expensive valuations, particularly within mega cap US stocks. While the top 10 holdings in the S&P represent approximately 30% of the index, they only generate 21% of the aggregate earnings—meaning they are, on average, more expensive than an index that is itself already expensive. In the long run, we believe in the growth potential of owning great companies and that the current cycle will prove materially similar to previous cycles. As the saying goes, the four most dangerous words in investing are “this time is different.” In the near term, however, if we need to raise cash, we would be very comfortable trimming stocks at current prices. Therefore, we recommend that clients be ready and willing to rebalance their equity portfolios if they need liquidity heading into year-end.

What Keeps Us Up at Night?

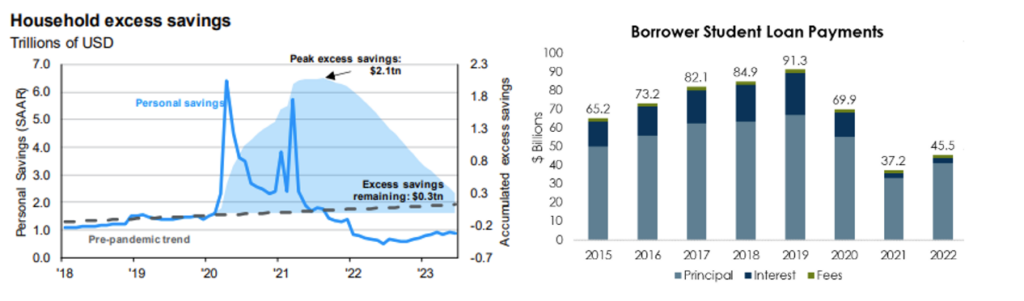

Risks and opportunities don’t tend to be mutually exclusive. The risks that keep us up at night often yield some of the best opportunities. Currently, while the economy has proven resilient, there are harbingers of weakness that are starting to pop up. As the charts below highlight, consumer spending—the largest driver of economic growth in the US—is facing some meaningful headwinds.

Having depleted excess savings built up during the pandemic, wages will need to increase and/or consumers will have to cut back. In addition, the moratorium on student loan payments is set to end on August 31st, which should curtail spending on the margin. Cracks are beginning to form within consumer spending as well. For example, auto and credit card loan delinquencies have been rising and are now above pre-pandemic levels. While this implies caution, we also believe that it will yield some attractive pricing opportunities for investors willing to reduce liquidity and step into distressed situations.

Our focus in the near-term therefore remains on the likelihood of volatility as the global economy works its way through several macro and geopolitical factors. The need to contend with uncertainty is not unique, so we would caution anyone from extrapolating too much from the current set of circumstances. Our philosophy has always been to be long-term, multi-asset investors. Unsurprisingly, we have never made a habit of recommending big shifts in asset allocation as a result of near-term risks. We do, however, look to tilt portfolios and rebalance opportunistically based on our assessment of the relative risks and opportunities between asset classes. Based on our current outlook, we believe fixed income allocations should prioritize quality and opportunistic illiquidity. We believe that public equity allocations should be actively rebalanced to take advantage of expensive valuations. For those who have the appetite and time horizon, we believe in continuing to systematically commit and deploy to private equity. We believe that patience is warranted as core real estate assets work their way through a changing interest and cap rate environment.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.