While the official advance release of Q2 GDP from the Bureau of Economic Analysis will not be until later this month, the Atlanta Fed produces their GDPNow forecast, which is designed to be a “live” tracker of economic growth that adjusts to various data releases throughout the quarter. Based on the latest release this week, it estimates Q2 GDP as having declined by 1.2%. If this estimate holds true—which is admittedly a big “if”—this would imply, by the most basic definition, that the US economy has entered a recession.

On the inflation front, this week’s release of June core CPI reflected yet another eye-popping rate of increase year-over-year. While we have started to see some moderation in commodity prices over the last month across all sectors of the commodity market (energy, agricultural, industrial and metals), inflationary pressures stemming from a resilient labor market and lagging factors (like owners equivalent rent) will likely keep pressure on the Fed to maintain their tightening course. Businesses are taking note. In their most recent earnings insight report, Factset highlighted the degree to which companies continue to express concerns over labor costs and the impact to earnings going forward.

Analysts are taking note. While the first half of the year saw a significant number of cuts to economic growth forecasts, it was curious that—for the most part—earnings forecasts remained unusually resilient. That trend has begun to shift of late, with earnings expectations beginning to moderate for the back half of the year. We’ve also notably seen several US companies express restraint in their hiring expectations for the rest of 2022. We would expect to see this trend continue—after all, the goal of tightening monetary policy is to cool down an economy that has over-heated.

The bond market is certainly reflecting this reality. Credit spreads have almost doubled from where they were to begin the year and as the chart below illustrates, we have finally seen a sustained inversion of the yield curve.

Our outlook continues to be one of near-term caution. Predictably, market performance so far this year has seemed to anticipate much of the challenging news that is now becoming a reality. However, our focus is not on how to invest in a recession, but how to invest through a recession.

Myth of Market Timing

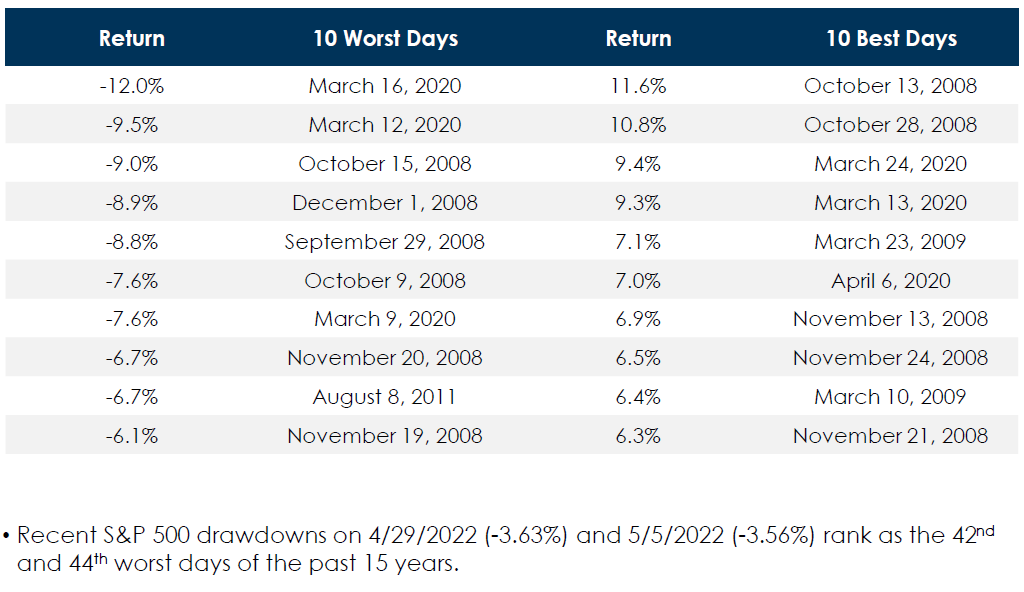

Like the sirens song luring sailors to their peril, these periods of market extremes provide us with a predictable temptation—we must time the market! We all know how difficult it is to do. We also know how many very smart and very reasonable investors have tried to do it, only to be humbled time and time again. As the table below implies, one critical challenge facing any market timer is the speed with which sentiment can shift and drive outsized market moves. The global financial crisis was a perfect example. The top 5 worst days and the top 5 best days during that period all occurred within approximately 2 months of each other.

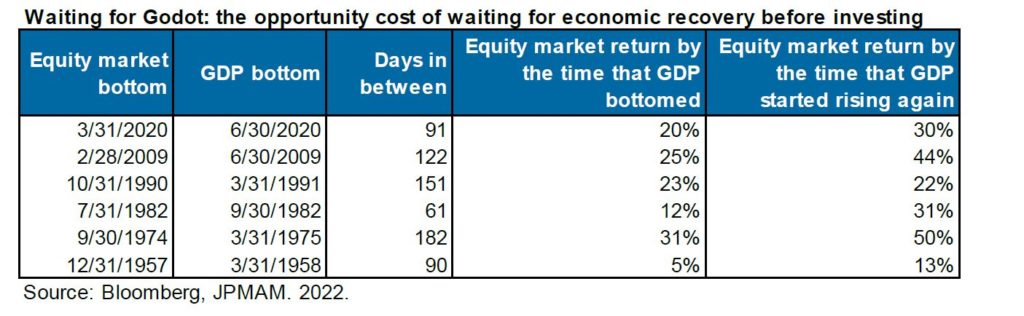

In addition to the speed with which markets can move, market timers must also contend with the inconsistency in the degree and magnitude of the market’s anticipation of future conditions. The table below summarizes the performance of equity markets in relation to the actual economic conditions at the time—with markets bottoming anywhere between 2 and 6 months prior to GDP finding its bottom.

No surprise here, but we believe that timing the market is an exercise in futility (if not to say luck), therefore we focus our energy in other ways.

Investing Through a Recession

Trust Your Preparation

Much of the success investors have in navigating challenging markets is less in the actions they take during the period in question and more in the work they do ahead of time. In our world, that means trusting the process that has led us to pick the funds and managers with whom our clients invest. The result of that process is a grouping of managers that are looking for high quality companies—the kinds of companies that will have greater success in working through tough economic periods. Examples of such characteristics include, among others:

- Conservative or optimized levels of leverage on their balance sheets—a particularly timely benefit during periods of rising debt costs

- Defensible business models and moats, which provide them with greater pricing power during periods of rising prices

- Excellent management teams—these are management teams that are focused on driving long-term value for their stakeholders and have a proven ability to manage through rockier times

While not always visible in the day-to-day trading prices of the underlying stocks—as market momentum can and does create pricing dislocations—we are seeing managers take advantage of their discipline. In the equity markets, funds are maintaining their positions and/or upgrading their holdings. Fixed income managers who have the flexibility to invest in higher yielding debts are being more conservative in their deployment—in part due to the reality that the Fed is unlikely to reverse course and provide accommodation to the credit markets. So while at a high level it may not appear that much is changing in portfolios, below the surface we are looking for and taking advantage of the opportunities that volatility typically presents.

Know Your Risks

Former PIMCO CIO, Mohamed A. El-Erian, wrote an interesting article for Bloomberg News this week in which he addressed the concept of risk-factor analysis and the importance of knowing the underlying sensitivities of an asset class/investment to different market factors (interest rates, credit, momentum, etc.). It speaks to a more thorough understanding of what risks an investor is willing to take and what risks they are not willing to take. Our approach to portfolio management over the last 18 months has, and will continue to be, a corollary of that concept in that we want to identify what portion of our client’s goals must be all but immune from risks and which goals afford us the opportunity to take risks.

We continue to believe that reserves for known cash flows (lifestyle spending, taxes, etc.)for the next 6-12 months should be maintained in cash, as opposed to extending too far out on the yield curve. To that end, as a product of the Fed’s rate hikes, we are finally starting to see normalizing yields on money market funds, which does provide some added income to portfolios. For those needing to raise cash, we think it is appropriate to look at segments of the fixed income and equity markets as a potential first source to raise it—with a particular focus on liquid absolute return and eventually high quality US stocks that have maintained their value through the downturn (dividend payers for example). For assets that have a longer time horizons, we think taking a measured approach to rebalancing makes sense. Valuations across high quality growth companies, as well as riskier segments of the markets like small cap US and emerging markets have come down materially and could represent good buying opportunities for those willing to accept some near-term downside risk.

Where do we go from here?

The current market correction has been driven—in large part—by the contraction of equity multiples in the face of rising interest rates and inflation. Based on current forward-looking earnings expectations, valuation metrics look reasonable. That being said, there is likely to be a second phase to this market, which is the processing of earnings revisions and the corresponding price actions. Being long-term optimists, our charge in this environment will be to identify opportunities to rebalance and add to great investments that have seen near-term price reductions. In addition, we are continuing to evaluate private investment opportunities as they come to market, as we believe they can represent differentiated long-term growth opportunities for clients with the appetite and ability to take on illiquidity risk.

One last point. The war in Ukraine continues to be a significant x-factor, not just in the context of commodity prices and energy instability (acutely in Europe), but also in terms of the implications of a multi-polar world order. Looking in the mirror here in the US, we find numerous sources of disappointment and confusion within our government and societal fabrics. That said, a global business landscape in which autocrats and totalitarian rulers hold major sway warrants a different level of risk assessment. As such, while we are beginning to see the underpinnings of opportunities in companies all over the world, we are being deliberate and thoughtful in when and where we rebalance and add risk.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.