If the only two things in life that are certain are death and taxes, a close third would be presidential election cycles. Now, not all election cycles are equal. Some are highly contested, whereas others have a clear front-runner. Some elections involve an incumbent and a challenger, while others involve two candidates who would be new to the presidency. Each election takes on a life of its own, but sure as the sun rises in the east, every 4 years, Americans head to the polls to cast their vote for who will lead the executive branch of the government.

The paradox of the predictability of the election cycle and the unpredictability of the process and outcome creates an interesting dynamic in the markets. We frequently get this question from our families: “If [insert candidate name] wins the election, what does it mean for our investments? “ There are quite a few layers to that onion, but we’d like to explore the answer to that question, based both on what has historically happened, as well as what it might mean in the coming election cycle.

Acknowledging Our Bias

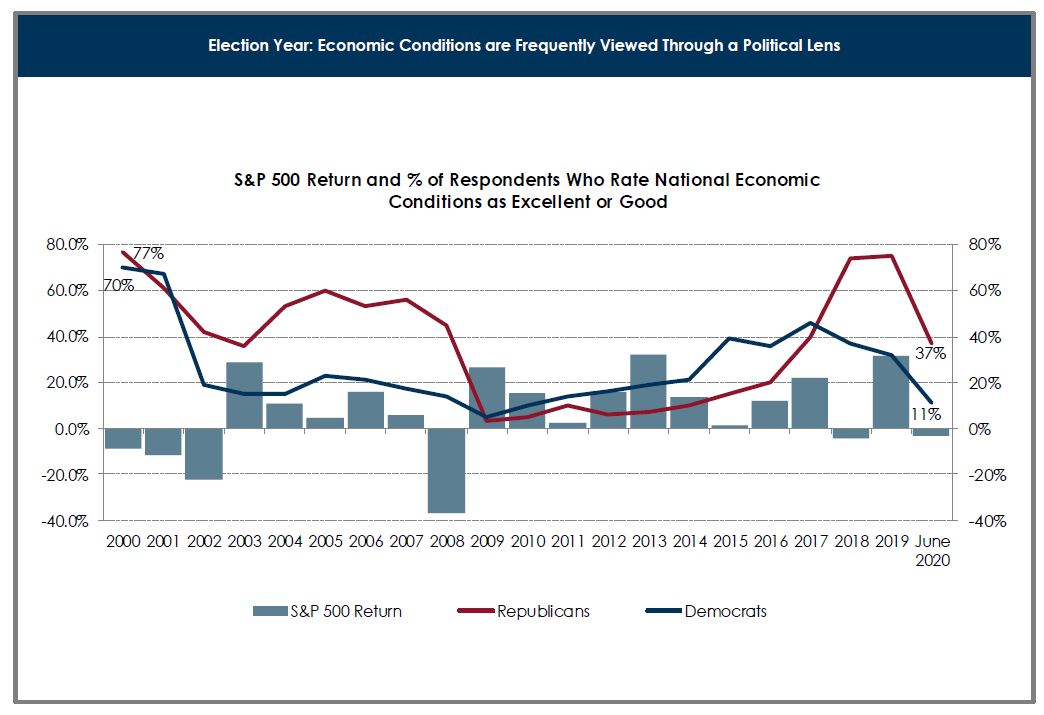

The purpose of this piece is not to share any political biases. We want to view political factors through a neutral lens and identify the economic and market implications when possible, but we know this is a polarizing subject. We thought the chart below was interesting, as it shows the intersection between perspectives and expectations and our biases at work. The red line reflects the % of Republicans who have a positive outlook on the economy at a given time, while the blue line reflects the % of Democrats who have a positive outlook. Somewhat predictably, Republicans are more optimistic than Democrats when there is a Republican in the Oval Office and vice versa. The fact is, our personal economic outlook can be impacted based on whether our personal political affiliations are aligned (or not) with the Commander in Chief. We aren’t bringing this up as an indictment of our personal points of view, but rather as a reminder that challenging those biases is essential to a thorough investment process.

Quick Spin through History

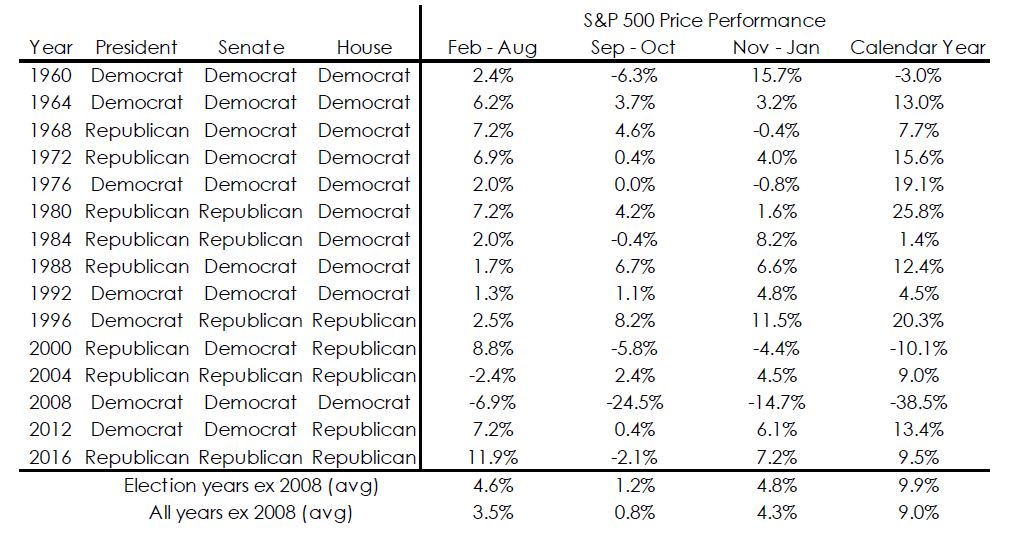

Getting back to the topic at hand, the election in November, our analysis starts with a look at past election cycles to answer two different questions. With the caveat that this year has been anything but typical, the first question is: are there any trends within elections years that might be worthwhile to understand? If we break out the election year into three distinct phases, we can draw some conclusions. Phase 1 is the lead up to each respective primary, phase 2 is the lead up to the election in November, and phase 3 is post-election. As the table below indicates, the period of September and October yields the highest degree of volatility, with one rationale being that markets are attempting to cope with the uncertainty of knowing which candidate (and their policies) are most likely to be the reality going forward.

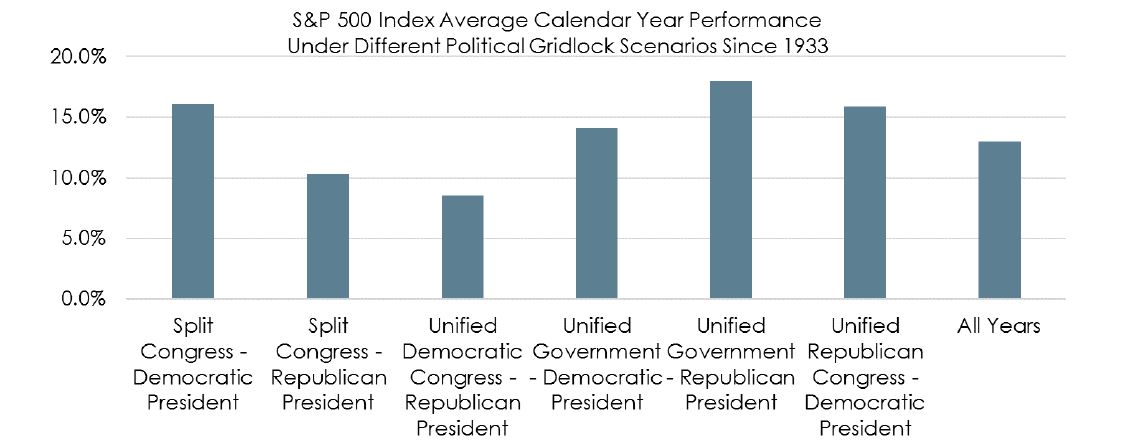

The second question is: does the outcome of the election impact future market performance? This one has more nuance than insights, as the US economy is a highly complex web of influencing factors, of which the government is only one. As the chart below further illustrates, the President’s political affiliation yields little in predictive value when considering the market returns during a given administration.

What Comes Next?

Volatility most likely. The world is continuing to search for ways to cope with the ever-changing circumstances surrounding COVID-19. As this article goes to press, several countries in the Middle East have reinstituted lockdown measures to combat spikes in cases, and countries across Europe are considering following suit. In the US, we are facing one of the more contentious elections in recent memory, which only magnifies the volatile set of circumstances. To further understand the range of outcomes, we thought this policy comparison prepared by Bloomberg Tax & Accounting was a helpful summary. Ultimately, while we won’t know the policies that will shape the next 4 years (and beyond), irrespective of the outcome in November, whoever is elected will have to contend with a tough economic reality. High unemployment. Rising defaults. Mounting debt levels. Low–interest rates. High equity valuations. All of these contribute to a near–term outlook that implies higher volatility. Several of these factors are cyclical in nature, though the ones we are currently most focused on are the implications of heightened debt levels and low (or negative) interest rates. There will be more to come from us on the latter in the coming weeks… stay tuned!

As we look to turn the corner on the 3rd quarter and head into the last three months of the year, we remain focused on what we can control. We expect higher volatility in the near–term – which should allow us to be thoughtful and prepared if/when it comes and to maintain our long-term discipline. While the focus of this letter has been investments, Matter believes in an integrated approach to wealth management. To that end, we thought we would highlight a blog piece authored by our Partner, Brian Fernandez, which details some of the planning considerations that could arise as a result of the election. The end of the year has the potential to be quite busy. In the meantime, we hope that your families continue to stay safe and healthy and we look forward to seeing you all again in person as soon as prudent.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.