As the third quarter draws to a close, we find ourselves in one of the first prolonged down markets since the global financial crisis. In a way, it is natural to believe that “this time is different” because, it has been. The previous bear market during COVID and the “almost” bear market in Q4 2018 were very quickly resolved—in both cases, the markets had recovered from their lows within about 3 months. Ironically, we are now faced with the consequences of the mechanisms that allowed for those rapid rebounds—namely easy and accommodative monetary policy by global central banks—which most market observers would agree has been one of the key drivers of the inflationary pressures we are now looking to contain.

The result has been historic levels of inflation, aided by commodity pressures stemming from the war in Ukraine, which has forced most central banks (there are some exceptions) to quickly raise interest rates to levels not seen since 2008. The impact across asset classes has been material and acute. Most stock market indices (S&P 500, Nasdaq, Russell 2000, MSCI EAFE, and MSCI Emerging Markets to name a few) are down over 20% from their peak—which is the admittedly arbitrary measure of a bear market. Further, bond markets have not provided the typical flight to quality protection that investors can usually expect. The Bloomberg Aggregate Index is down almost 15% year to date, which is more than double the decline it saw during the taper tantrum in 2013 and would put it on pace to be—by far—the worst annual return for the index since its inception in 1976. In short, with few exceptions (commodities and real estate) there has been little room to hide for diversified, long-term investors.

The Search for Fair Value

The question becomes where will we find equilibrium? Where is the balance between rising interest rates and inflation, between earnings growth and valuations, or among currency exchange rates?

Inflation & Interest Rates

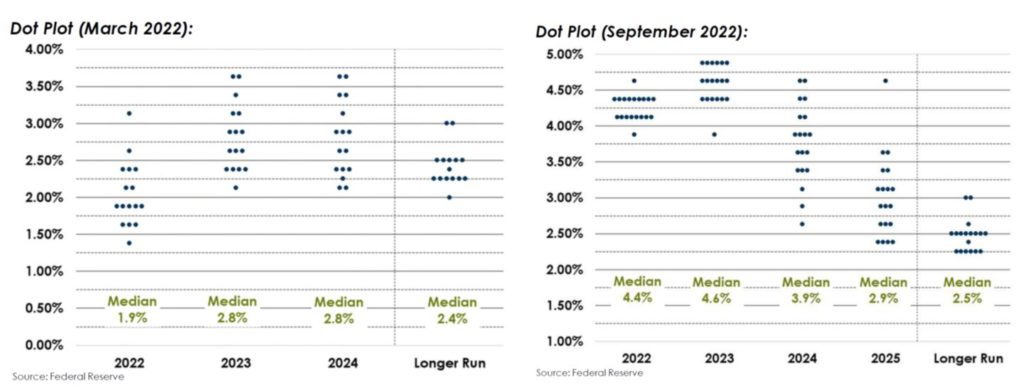

If we learned anything from the last 6 months it is that we are far from gaining consensus on where interest rates will end up in this hiking cycle. Below are two of the famous Fed dot plots, the charts that record where each fed official projects the fed rate will be at a given point in time. The chart on the left is from the Fed meeting in March, the chart on the right is from the Fed meeting in September.

There seems to be a consensus among Fed members that interest rates in 2023 will need to be much higher than expected just 6 months ago. However, if we turn our focus to 2024, not only do we see a higher median rate forecast, but we also see a very wide range of opinions—with some members believing rates will need to be above 4.5%, while others believe they will need to be cut back to 2.75%. Whether interest rates remain elevated or begin to decline next year (as implied by the futures markets), our perspective is that equity markets are no longer in the “TINA” (there is no alternative) phase and that bonds are offering increasingly reasonable risk and return profiles.

Earnings Outlook

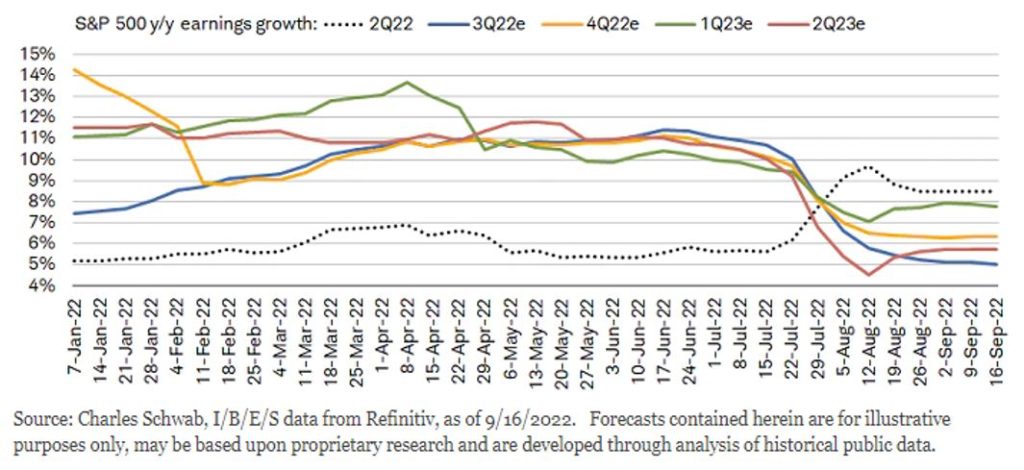

As we discussed in our last blog post, despite the challenging macro dynamics, we believed it was odd that we had not begun to see some more material revisions to earnings guidance going forward. That phenomenon is now shifting. While consensus earnings for the S&P 500 have only declined modestly from $229 to $225, every day we are reading about further earnings forecast reductions. The chart below reflects the year-over-year earnings growth expectations by quarter and clearly analysts are beginning to price in a more muted growth environment.

The key question is whether it is realistic to assume that we go through a recessionary period without seeing an actual decline in earnings? History would argue it is not. It is because of this that we are still cautious despite being at valuation levels that would argue for a more sanguine approach to rebalancing.

Exchange Rate Volatility

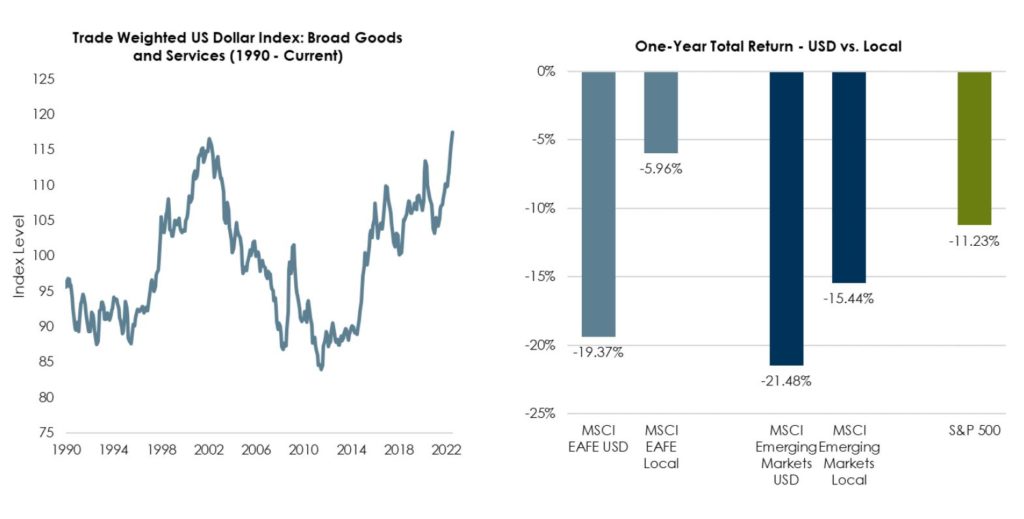

Simply put, as the charts below illustrate, the US dollar has never been this expensive relative to other currencies and that has wreaked havoc for US investors who own companies domiciled (and priced) outside of the US.

On a forward-looking basis, the strengthening of the US dollar will be a material factor that companies will have to navigate as they reconcile the denomination of their revenues and expenses. For example, companies in the US with non-USD sourced revenues will have to contend with the negative translation effect of recognizing those non-USD revenues in USD. For context, almost half of the revenues generated by S&P 500 companies come from outside of the US. In addition, if the strength of the dollar persists, it creates a competitive advantage for businesses selling non-USD priced goods and services as the price of those goods and services will, all else being equal, appear more attractive.

Portfolio Implications

While rising interest rates and declining valuations all factor into a forward-looking return profile that is more attractive than it was 12 months ago, we remain cautious in the near-term as the search for equilibrium tends to be volatile. Despite the recent sell-off, the VIX has not reached the typical level that would imply capitulation in equity markets and high yield spreads are still at or below their long-term averages—though interestingly we’ve seen more significant widening among the lowest rated issuers.

While every portfolio is different, and therefore subject to a unique set of constraints, our portfolio thoughts boil down to three key themes:

Knowing What You Own

We partner with our colleagues at Asset Consulting Group and spend a considerable amount of time and resources vetting and evaluating the money managers with whom our clients invest. Our goal is to identify managers who focus on the fundamental components of the businesses and assets they own and take a long-term, convicted approach to building their portfolios. We believe that this provides us with the best opportunity to preserve and grow long-term wealth. While this does not immunize our portfolios from the daily gyrations of the markets—as we’ve seen this year—our expectation is that we will come through the market cycle owning the businesses that have been able to weather the storm and capitalize on the recovery.

The Prudence of Patience

While fortune favors the bold, risk often fools the reckless and the line between the two can be a mirage for those who are not careful. Our approach has been, and will continue to be, to make small incremental changes that allow us to remain close to our long-term strategic targets, while buying or selling assets at what we believe represent attractive or reasonable values. There are no obvious areas of opportunity or obvious areas of asymmetric risk, meaning the prudent strategy is to stay focused on the long-term and not get caught up trying to be overly cute in our portfolio management.

Rebalancing When It’s Uncomfortable

By definition, rebalancing involves selling assets that have done well (your “winners”) and buying assets that have not done as well (your “losers”). That is a tough task even during good markets, however during difficult markets it will feel counterintuitive and downright uncomfortable. That is the challenge we face, as we can envision some rebalancing opportunities ahead that may seem difficult to rationalize. An example may be moving into fixed income when absolute yields look reasonable, but real yields are still in question – or looking outside of the US for growth opportunities – or even selling real estate after it has played an important inflationary hedge for us. None of these decisions will seem obvious when we make them—only hindsight can provide that certitude—but having the courage and conviction to be disciplined is one of the foundations of our investment strategy.

We would expect to see continued volatility as the markets seek to find their equilibrium points across a variety of factors. Therefore, we are advocating for a patient approach to managing portfolios. We think it is likely that the market will get worse before it gets better, and if it does, we will be looking to add to our high conviction investments on weakness. We have been through market cycles, and while they are all different—and feel different in the moment—we believe they are a natural step on the path to long-term growth.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.