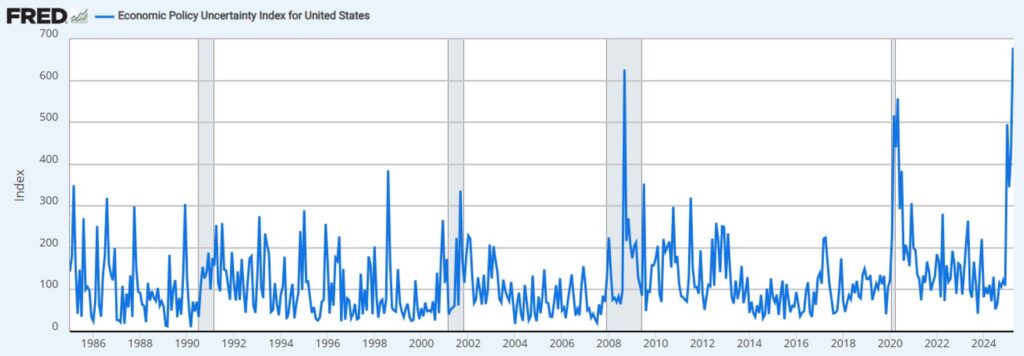

Having experienced the tech bubble, the global financial crisis, and the pandemic-era dislocation, we are no strangers to volatility. But this past week stands apart—not for the size of the moves alone, but for the speed and sentiment-driven nature of the swings. The level of market chaos feels disconnected from fundamentals and is, instead, tethered to the unpredictability of policy signals coming out of Washington. As illustrated by the chart below, policy uncertainty is now at unprecedented levels.

The Fragility of Sentiment

As of the end of last week, US stock indices had returned the following YTD:

S&P 500: -8.5%

Nasdaq: -13.2%

Dow Jones: -5.0%

Russell 2000: -16.3%

Outside the US, markets are faring slightly better:

MSCI All Country World – ex US: +0.8%

MSCI EAFE: +2.4%

MSCI Emerging Markets: -2.2%

Investment-grade bond markets have provided better returns, with the Barclays Aggregate Index posting a 1.1% return YTD. There has been some concerning volatility in US Treasury markets, however, with yields on the 10- and 30-year treasuries having spiked 40-50 basis points since tariffs were first announced. More on that dynamic later.

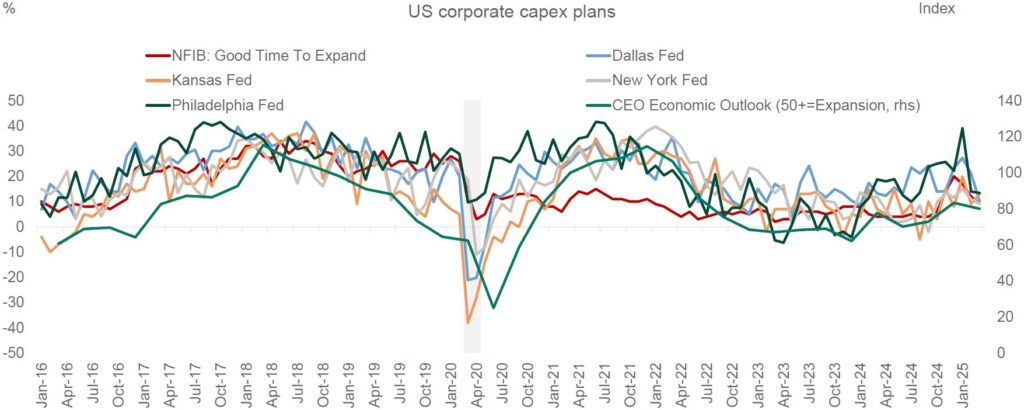

Unsurprisingly, sentiment has eroded rather quickly in the face of uncertainty. The University of Michigan’s Consumer Sentiment Index dropped to 50.8 in April. This represents the largest 3-month decline in confidence since COVID and the 5th largest decline since 1978. Business optimism is also waning, though less dramatically. The National Federation of Independent Business (NFIB) Small Business Optimism Index declined to 97.4, showing a steady decline since the index level jumped following the election in November and the presumed hope for deregulation under a second Trump administration. In contrast, the US economy added 228,000 jobs according to the Nonfarm Payroll report published by the Bureau of Economic Analysis, nicely above the average over the prior 12 months. These are conflicting indicators to say the least, and a source of hope that a recession could be avoided should policy clarity come quickly. The challenge, however, is that the lack of clarity and the impact it has on the outlook for the future could result in a self-fulfilling prophecy. As the chart below indicates, planned capital expenditures have declined sharply since the beginning of the year and this withdrawal of investment could help tip the economy into recession.

A Cautionary Parallel: Brexit

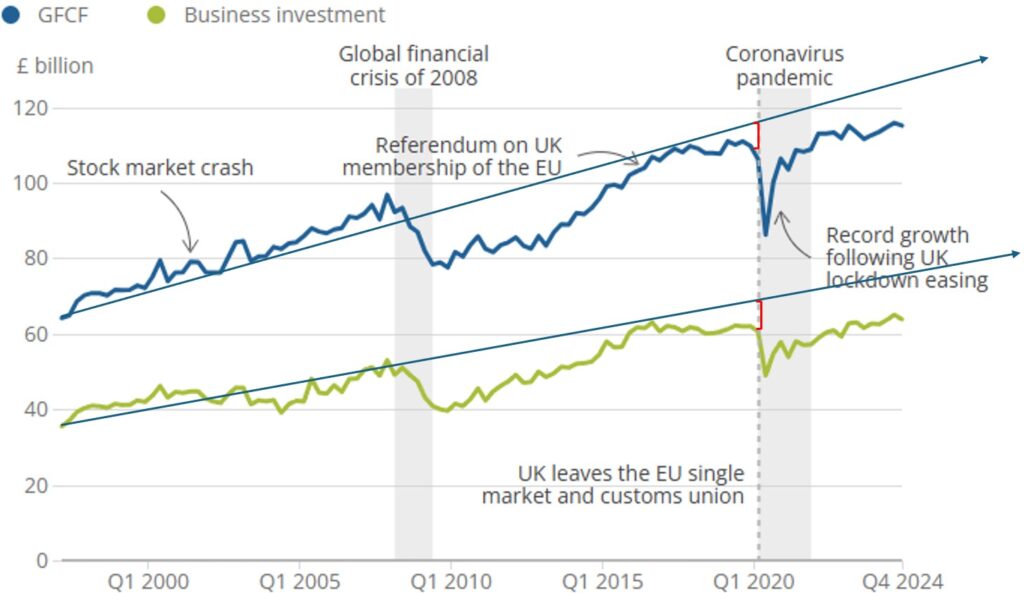

We don’t subscribe to assigning specific probabilities to the near-term direction of the economy and we believe that any attempt to do so at this point is highly speculative given the pace at which the rules of the game are changing. The bigger concern we have is the long-term impact that a prolonged policy vacuum could have on the US economy. One recent analogy that comes to mind is that of Brexit and the period of limbo that followed the referendum vote in 2016. The chart below is from the Office for National Statistics in the UK, and it shows the Business Investment and Gross Financial Capital Formation in the UK.

We added the trend lines to reflect the pre-2016 trajectory. The investment plateau following the referendum resulted in an investment reduction of over 10% compared to pre-2016 trend levels. Future economic growth relies on investments made today to drive output and productivity growth. Absent a reliable policy framework, we might be threatening our ability to invest toward the future, which could have a longer-term economic impact.

The Risks of a Hostile Negotiation

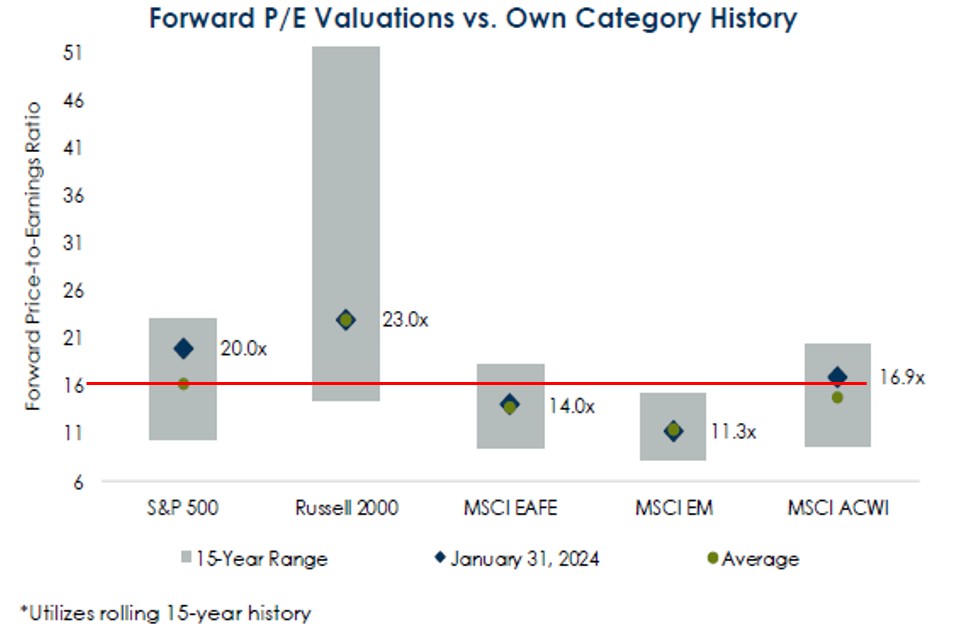

As we explained in our letter to clients immediately following the tariff announcements on April 2nd, predicting the specific outcome of tariffs with any degree of certainty represents a fool’s errand as it involves predicting the behavior of thousands of companies and millions of actors. One hypothetical that is becoming increasingly likely each day is that we begin to see an erosion of the valuation premium that has been afforded to US companies. As the chart below illustrates, for the last 15 years, US companies have enjoyed a higher valuation multiple than their international counterparts—and for good reason.

The US is home to some of the most innovative and dynamic businesses in the world. In addition, we generally maintained a legal and regulatory environment that was, on the margin, more attractive than many other international jurisdictions. Lastly, the trade deficit that is so maligned by the current administration has resulted in the flow of US dollars going to foreign investors who have subsequently reinvested some of those dollars into US assets.

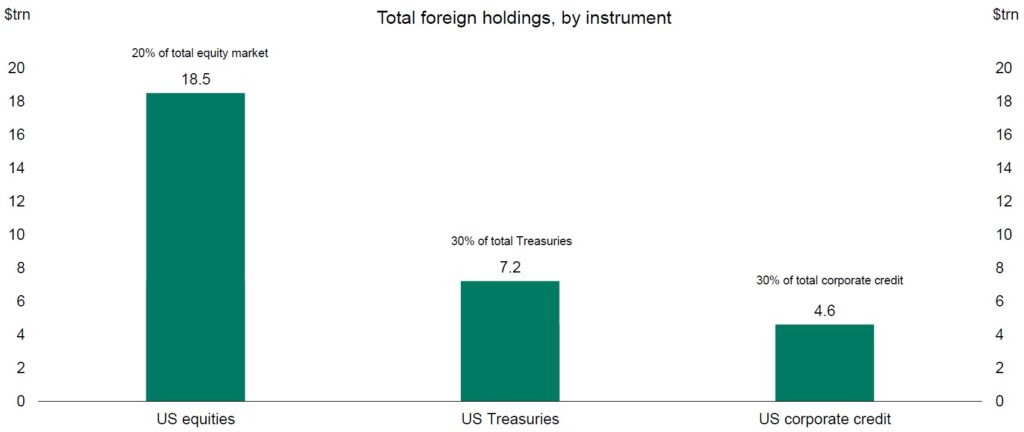

As the chart above illustrates, there is significant foreign ownership of US equities and US bonds. This highlights that our trade partners have not been quite the parasitic actors they are currently made out to be. There is no doubt that certain countries (or industries) have engaged in unfair trade practices, but to paint them all with one brush implies a victimization of the United States, which is factually not supported and unproductive. Additionally, significant foreign ownership of US assets is a leverage factor that needs to be carefully considered as we negotiate trade deals with foreign governments. The recent volatility in the US Treasury market should be viewed as a cautionary tale. Over the last week, we have seen interest rates on longer-dated US treasuries spike, leading many to speculate that a combination of foreign selling as well as the unwinding of a popular hedge fund trade is to blame. As Oaktree’s Howard Marks spells out in his most recent memo, when we negotiate on trade, we would do well to acknowledge the golden credit card our economy, rule of law and fiscal solidity have afforded us.

Portfolio Implications

Equities

The risk to the US valuation premium is material and one that argues for, at best, a neutral positioning towards US equities. We can’t ignore the possibility that the administration is able to quickly negotiate some trade concessions and then move on to their other policy promises of lower taxes and further deregulation. That being said, large US companies in particular are more exposed to global trade, as almost 50% of the revenue of S&P 500 companies comes from outside of the US. By comparison, less than a quarter of the revenue of companies in the MSCI All Country World Index ex-US comes from the US. In other words, US companies rely more heavily on foreign revenues than non-US companies rely on US revenues. When you layer in the promised fiscal stimulus in Europe, the valuation discount currently applied to non-US equities and the likely decline of the US dollar, we think the outlook for companies outside of the US is attractive. Private equity continues to be a focal point of our portfolio construction. No doubt, these companies are subject to the same macroeconomic factors that drive company performance in the public market. They do not, however, have to contend with the same day-to-day gyrations (and possible distractions) of publicly traded stocks, nor do they have to live by the same quarter-to-quarter earnings pressures. As we highlighted in our recent piece on private equity, we believe in the opportunities that are present in the venture capital, lower middle market and buyout ecosystems. Specifically, we have recently completed diligence on S32 ventures, a venture capital fund that is well-positioned to capitalize on the next evolution of AI—one that moves from the broad application of AI models to the training and application of models for highly differentiated and complex data sets.

Fixed Income

The volatility in the US Treasury markets has put bond investors on notice. We believe diversification of issuers and instruments is the key to managing through this current market environment. We favor an active approach to managing bond portfolios at this time—one that emphasizes fundamental analysis and a thorough understanding of the underlying credit fundamentals of the instruments in portfolios. It is no doubt more expensive to use active managers to invest in fixed income, but we believe flexibility and active security selection will be a net benefit to clients. It is also worth noting that we have seen an acceleration in the capital drawdown of one of our distressed credit and special situations managers, Oaktree. We are continuing to look for opportunities within the private credit space as we think the risk of illiquidity is worth the potential for added value.

Real Estate

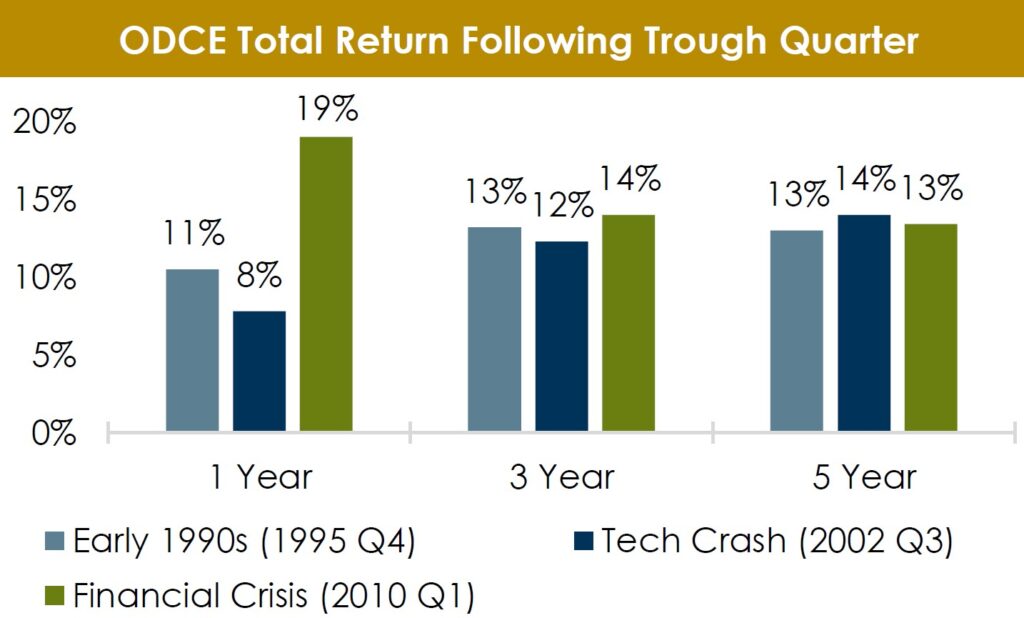

Coming into this year, it seemed as though real estate was finally ready to turn the corner. The ODCE Index posted its first positive quarter in Q4 2024 which, as the chart below shows, was a positive signal for forward-looking returns.

We continue to believe that real estate offers reasonable value, though there are some factors that are working against it. The first is that an increase in interest rates is likely to weigh on both capitalization rates as well as net operating income (NOI) growth, as the cost of debt would increase on the margin. The second is that a tight labor market, coupled with a potential rise in input costs, would presumably put pressure on and curtail new development. Any reduction in new products coming online should theoretically be supportive of pricing for existing properties which, when combined with reasonable valuations, leads us to have a constructive outlook

Conclusion

Navigating the current market environment requires equal parts discipline and adaptability. While the noise of the daily headlines and policy speculation (or reversals) can be overwhelming, our focus remains on building resilient portfolios grounded in long-term fundamentals. We are not in the business of making bold, short-term predictions –we are in the business of stewarding capital across generations. That means staying intellectually curious and open to opportunities that lie beyond the traditional toolkit. We are actively evaluating concentrated active managers, niche investment strategies and other strategies that can provide us with uncorrelated sources of alpha and differentiated returns drivers in this evolving landscape. Though the path forward may be volatile, we believe that disciplined investors, those who remain focused, flexible and forward-looking, will continue to be rewarded.

About Thierry J.D. Brunel

Thierry joined Matter in 2013, bringing years of experience in family office and wealth management. He previously worked in investment research and portfolio management roles at Convergent Wealth Advisors and GenSpring Family Office. At Matter, Thierry leads the investment committee, advising families on portfolio strategy and governance. A Wake Forest University graduate, Thierry has a diverse international background. He’s active in his community, serving as an assistant coach for the John Burroughs School Varsity football team in St. Louis.

Other Blogs by Thierry

This report is the work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.