Around the beginning of every New Year, we are treated to an array of prognostications by various market pundits, who would propose to tell us, as investors, where the markets are headed for the following 12 months. The S&P 500 index will end the year at X and the price of oil will be Y, they tell us. No doubt, significant thought and research go into these predictions. Sadly, however, despite being well-intentioned, hindsight usually proves that accuracy in such forecasts is elusive at best.

Last year is a perfect example. Performance predictions for the S&P 500 Index from 13 different financial institutions, ranged between 2% and 12.2% with the average forecast being 8.2%. These predictions proved overly optimistic as oil prices, Chinese growth and global monetary policies weighed on stocks and the S&P only returned 1.4% for the year.

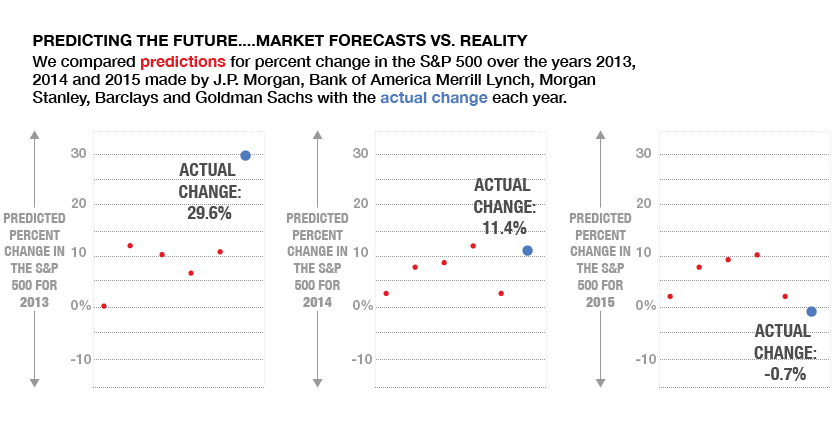

Now one year does not a trend make, however, the chart above reflects the predictions of 5 large Wall Street firms over the last 3 years and it tells a similar story: the range of return predictions is usually quite broad and their accuracy is usually quite limited. In fact, a broader analysis of the market predictions of 22 different market strategists from 2000 to 2014 found that the forecasts were off from the actual return by an average of 14.6% per year! Said another way, if the actual return for a given year was 10%, this group forecasted on average either a 24.6% positive return or a 4.6% negative return. Not very accurate to say the least. And, while on a given year one or two forecasts prove to be close to the actual experience, no one firm has proven to be remotely accurate on a consistent basis. That being said, we too read the market outlook pieces every year, though we do it with a heavy grain of salt. We think they are helpful in providing a broad view of the trends and sentiments that are prevailing in the markets, knowing all too well that the markets are dynamic and constantly changing. Like the weather, if you don’t like what the markets are telling you on a given day, odds are that if you wait a week you’ll find something different all together.

To be fair, as a practice, we at Matter do not put out our own forecasts for any given year, in part because we know that we would not have any greater degree of success than the rest of our peers! We believe that accurately predicting the directions of the markets in the short-term is a game of luck, rather than skill or insight. As a result, the vast majority of our asset allocation work goes into establishing themes that we believe are likely to persist for three to five years and using those as the backdrop for making strategic asset allocation decisions. This is not to say that we are not always evaluating the opportunities and making small allocation shifts when warranted. But they are just that—slight changes that are intended to enhance either return or risk on the margin, while keeping the longer term strategic targets as our desired course. One analogy to consider is that of a flight plan from New York to Los Angeles, it is established ahead of time and is pretty well defined—you’re heading West! However, over the course of the flight the plane’s altitude or direction may vary slightly to avoid weather patterns or such, but it is highly unlikely that the pilot would take you through Miami to get to LA. We believe managing portfolios is a similar process—we set the course ahead of time and make small course corrections where need be, but do not make wholesale changes unless the desired destination has changed.

2016 Recap – Maintaining Calm and Discipline in the Face of Volatility

Admittedly, the beginning of this year could have tested even the most seasoned investor’s convictions around asset classes and opportunities. Volatility has been the only real constant over the first three months of the year. And it has been both positive and negative. In mid-February, we were looking at stock markets that were down anywhere from 10% to 20% depending on the index. Fast forward to the end of March and most markets have erased their earlier losses and in some cases turned into gains. Suffice to say that it has been a wild ride, and yet it begs the question: what has changed? As long-term investors, our candid answer would have to be, not a whole lot! The underlying economic trends remain the same. The world is still growing, albeit at a slower rate. Interest rates across the world are still below long-term averages, though we are starting to see some divergence between countries that are keeping interest rates low and those that are beginning to tighten. Commodity prices have recovered somewhat, particularly precious metals and oil, though oil is still significantly below where it was a year ago.

With all of the preceding observations as our backdrop—that short term predictions are unreliable and volatility remains the only consistent factor, we believe that your family is best served by advisors that remain calm in the face of dramatic market movements and disciplined in our belief in long-term investing. We adhere to this philosophy, in part because it reflects one of the few truths of investing, which is that over the long-run fundamental factors like population growth and innovation drive economic growth. This growth flows through to the underlying companies and investments you own in your portfolios. Volatility will always be a given, and while it can create opportunities, we are careful to balance opportunism with discipline. The start of this year has been as good a reminder as any that the markets can cover a lot of ground just to end up in the same place that they started. We understand that these ups and downs can be uncomfortable and appreciate the trust and responsibility you put in us to help you make decisions that are in your family’s best long-term interests.

For additional insight into our tactical view and the capital markets, please click here to see a piece provided by our research consultant, Asset Consulting Group, that takes a lens to the various asset classes as well as broader economic issues. As a member of our Investment Committee, the work done by ACG helps shape our near-term tactical and longer-term strategic views.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.