The close of the second quarter was not without its dramatics. On June 23rd, the people of the United Kingdom voted to leave the European Union, a partnership to which they had been party (in one way or another) for over 40 years! The trading days that followed exemplified general uncertainty about the consequences of the vote, which we commented on in a brief note on June 24th. The markets reacted and then “un-reacted” to the news, and the net result of the vote was a quick bout of volatility, first on the downside and then on the upside. In fact, the relief rally that closed out the second quarter and allowed investors to recoup their losses from the trading days following the Brexit vote has continued into the first two weeks of July with the S&P 500 Index reaching all-time highs. The primary catalyst appears to be the same: the extension of low interest rate/easy money programs by central banks across the globe. While we are content to capture the returns provided, it is difficult to escape the feeling that we are borrowing from future returns, and that more muted expectations for the road ahead are warranted.

Click here to see the second quarter capital markets update provided by our research consultant, Asset Consulting Group.Politics in Play

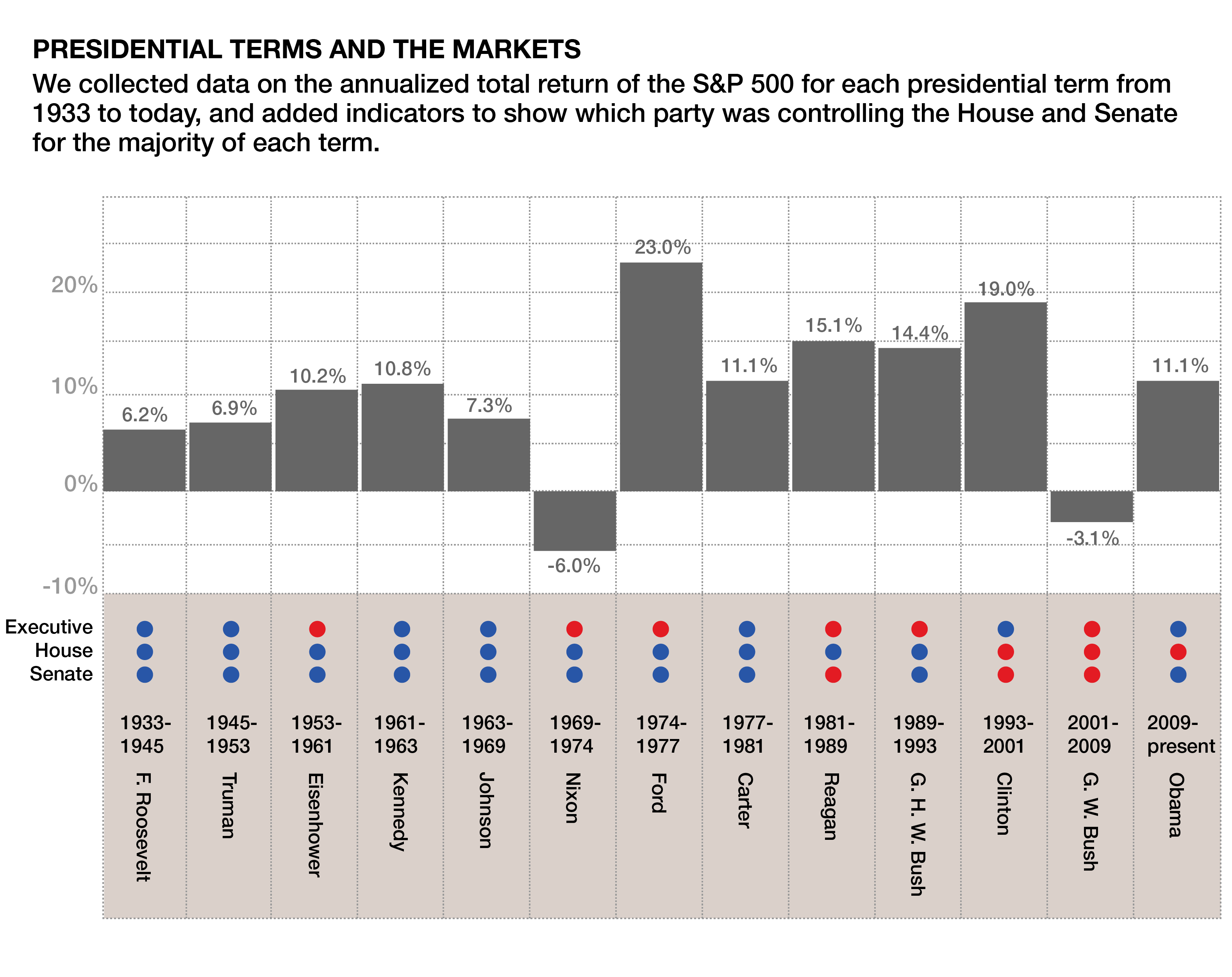

Domestically, our political process is generating feelings of unease. Partisan rhetoric appears to be leading us down an unproductive path, and we must concede that the results of the US elections could have a meaningful short-term impact on the markets. Whether it would be rational or not is still to be determined, but not to acknowledge and prepare ourselves for such a possibility would be a mistake. To that end, we queried whether history provides us any clearer lens into any tactical opportunities the elections may present. Is one party more “market friendly?” Are there trends within the election cycle itself? As you might expect, we find no sure bets. Asset Consulting Group completed an analysis of the market returns during different administrations dating as far back as 1901. As the chart below indicates, there is no one party that holds a monopoly on being the most “pro-market.” Any conclusions are debatable at best, though one we found slightly more defensible is the notion of the positive impact of a period of balance between the executive and the legislative branches of our government. The top three return environments occurred during periods in which no one party controlled both branches. With forward-looking conclusions being limited, we prefer to deal with the one “known” at this point: come January 2017, there will be a new inhabitant at 1600 Pennsylvania Avenue.

Preparing for Geopolitical Uncertainty

Our investment philosophy is centered on the identification of long-term themes as guiding factors for our portfolio allocation tilts. One of the five main themes we have been discussing for some time now is the increase in geopolitical and policy uncertainty that is permeating through developed and emerging markets alike. Whether it be our own election, the referendum in the UK, civil unrest in South America, power struggles in the South China Sea, or the continued humanitarian crisis in the Middle East, global stability appears to have been weakened. While we would not proclaim these to be harbingers of doom and gloom, we do take note. We also understand that uncertainty is the enemy of the markets. There is a strong possibility that we will see these risks manifest themselves through heightened volatility and more reactionary trading. So how are we dealing with this possibility in your portfolios? In earnest, some of these risks are systemic, and by definition are unavoidable. We do believe, however, that by maintaining a globally diverse allocation mix and a disciplined rebalancing program, we can weather these volatile storms if and when they come to pass.

Keeping an Eye on the Long Term

We can be sure that as we near the elections in November, we will be inundated with analysis and opinions about which candidate will be the most pro-business or pro-economy, and we believe that careful analysis of the facts is merited. However, we approach our analysis with a healthy amount of humility and understanding that, similar to the impact of the UK referendum, the impact of the elections will present itself over a period of months and years, and not a handful of trading days. Therefore, when volatility presents itself, we will find ourselves prepared to react, not to the noise and the fodder, but to the fundamentals of the investments that we identify as great long-term opportunities for you and your family.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.