In a year filled with high drama and surprising turns, 2016 has been unexpectedly good in the markets. As this market monitor through November 18th reflects, returns this year have been better than anticipated. Global stocks have returned 5%, with US continuing to lead the way. In addition, Emerging Market stocks, despite pulling back following the US elections, have posted returns just below 9% for the year. Fixed Income has generally been additive to portfolios, with high yield on pace for its best year since 2009. Yet even as we report on the positive results, we acknowledge the events that created real concern for the market amongst the families we serve: prospects of rising interest rates, Brexit, and most recently the unexpected presidential election results, for example. For more detailed data surrounding the current risks and tactical views, please follow this link to the materials provided by our research consultant, Asset Consulting Group.

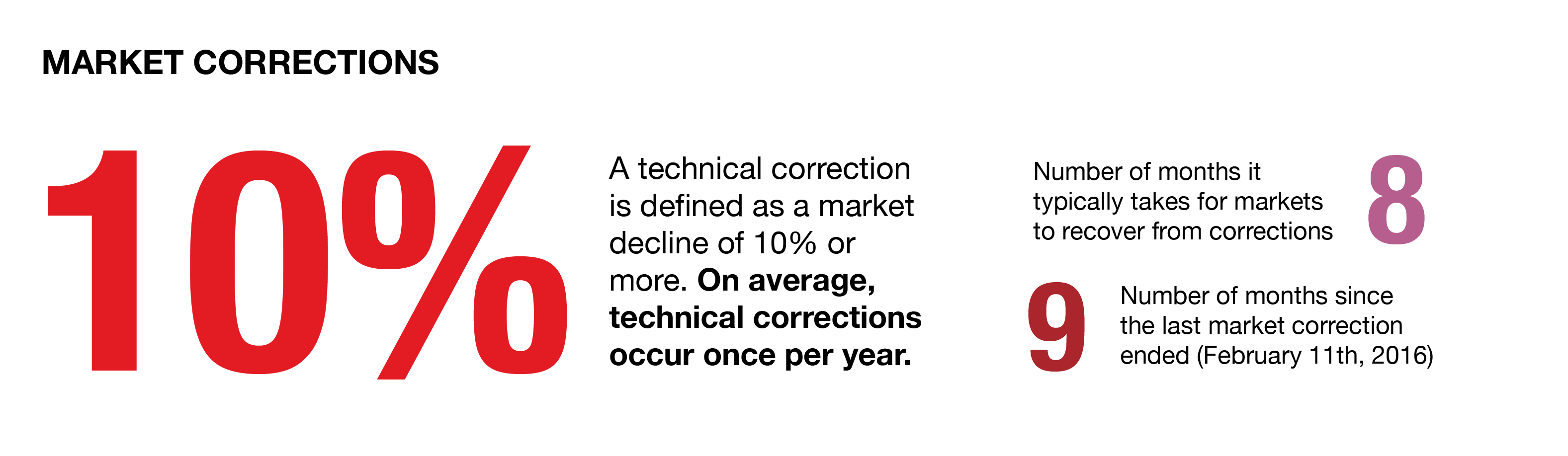

The volatility this year has been a good reminder of how quickly the markets react and how difficult successfully timing those reactions can be. For example, as stocks were experiencing a global sell-off of 7% in the days following the Brexit vote, it was hard to imagine that the markets would completely recover two weeks later! To put the speed of such ups and downs into context, we use history as our guide. The definition of a technical correction in the markets is a decline of 10%. On average, technical corrections occur once a year. The recovery periods for these corrections, meaning the time it has taken the markets to fully recoup their losses, has been eight months. This is not an inconsequential amount of time, but in the context of 10-20 years, it is a proverbial radar blip.

As we face possible influences of external events on the market, or even acknowledge that a market correction may be due, we use a few different approaches to ensure that we can navigate this instability without being reactive: The first is to take advantage of the opportunities presented by market volatility to manage the risk in your portfolios and actively recommend rebalancing steps along the way. Through rebalancing, we are systematically guided to sell assets when they have done better than others on a relative basis, and to buy assets when they have done worse than others on a relative basis. We view this as our opportunity to take what the market has given us. Another approach is to make the active decision to insulate cash for a finite period to cover lifestyle expenses. Raising some additional cash on the margin has its psychological merits, giving families the ability to avoid selling at market lows to fund lifestyle needs. This tactic requires discipline – while holding cash protects principal, it can also cause long-term growth impairment if cash reserves exceed what is truly necessary. Lastly, your portfolios organically create cash through payments received from sources such as interest payments from bond positions and dividends from stocks. This portfolio income can be very powerful as it allows us to weather periods of volatility that are unavoidable as investors in public markets.

As we approach the holiday season, the cocktail party chatter will be filled with many perspectives on this “Year in Review” and perhaps some discussions about the future. As your partner, we acknowledge both the positive year we are having and the risks that we as investors face. We look forward to 2017 with renewed commitment to your family’s long-term objectives, and we remain alert to both opportunities and risks. We know how quickly markets can change, both to the upside and the downside, and we acknowledge that no one can predict how or when this will happen with 100% accuracy. Even facing another unpredictable year, our strategy remains the same: we want to maintain enough flexibility to capitalize on the opportunities that volatility creates, while recalling that above all, we are investors who believe in the long-term growth potential of the assets in which your portfolios are invested.

We take this opportunity to thank you and your families for the responsibility with which you entrust us and wish you all a happy and healthy end of 2016!

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.