Matter families are familiar with our belief in the wisdom of long-term, strategic investments. Amidst the noise, we repeat our mantra over and over: think and act strategically, focus on the long-run, and don’t let the irrationality of the markets sway your systematic and rational approach. While we won’t fault those who might occasionally tire of this message or wonder if there is another way, we believe it’s the tried and true way to help families manage their financial capital. Nobody said it would be easy, and some moments test us more than others. But we’re closely monitoring market data and themes that might help shape our outlook.

For background and context, we’ll dive into some of the major factors currently at play.

Interest Rates

The Federal Reserve lowered interest rates earlier this month by 25bps, as the race to the bottom on global rates continues. Negative interest rates—a conceptual conundrum in and of themselves—are no longer a rarity, but a reality. There are currently over $15 trillion worth of bonds globally that offer investors negative yields. To put that in perspective, that represents over 25% of the Bloomberg Barclays Global Aggregate Index! Low interest rates have wide-ranging implications, both in the near-term as well as longer term.

Near term, a skeptic might ask, “If they lower interest rates before the next recession, and a recession still comes due to other factors, like trade and geopolitics, what will the Fed do then?” First of all, recessions are not only a normal but also a necessary part of the cycle. That aside, lower interest rates reduce a company’s (and individual’s) cost of capital, which, all else being equal, should have a positive impact on profits. Those profits can be recycled through the economy in the form of higher wages, capital expenditures, dividends, and (yes) taxes.

From a longer-term perspective, lower interest rates have a real impact on forward-looking return expectations–namely it lowers them. While low interest rates benefit borrowers, it penalizes lenders and savers. We have been discussing this as a persistent theme for the last several years. We believe that low interest rates should result in lower absolute returns going forward—across all asset classes—at least in the intermediate term (looking out 10 years).

The US Dollar

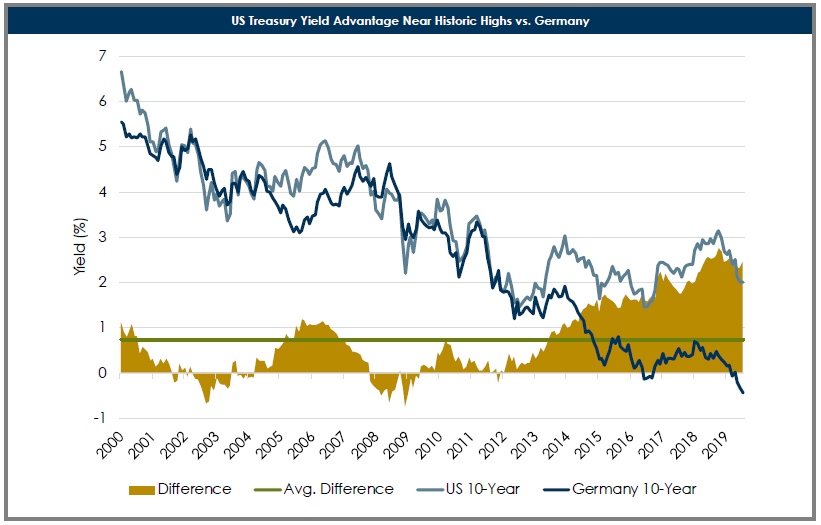

One of the byproducts of this interest rate environment continues to be the strength of the US dollar, which has experienced a seemingly uninterrupted climb since the summer of 2011. While 2017 offered a brief respite, over the last eight years, the US dollar has appreciated by almost 40% against a trade-weighted basket of other major currencies. One of the driving factors has been the differential between US interest rates and those of other developed markets. The chart below puts this into perspective: Since 2000, the average yield difference between 10-year US and German bonds has been below 1%—and it currently stands at over 2%. This higher yield differential increases the demand for the USD and drives its relative value higher, throwing a bit of a wrench in the global trade system.

Tariffs

Speaking of wrenches in the global trade system, tariffs continue to be the topic du jour. We won’t opine on the long-term implications of the tariffs and their impact on trade negotiations between the US and China, as the global trade and geopolitical systems are far too complex for us to claim any unique insight. But we can observe the following: The global supply chain has become an inextricable component of our business and personal lives. All we have to do is reach into our pockets or purses and pull out our phones—built predominantly outside of the US, utilizing apps and services created and offered by companies across the globe, and operating on networks managed by US-based providers—to see that reality for ourselves. We are walking examples of the integration of global trade. Any risk to that system should not be taken lightly.

Investment Implications

So you might be asking yourself, what does this all mean for me? Why do we (or should we?) stay invested? While one of our themes going forward is lower or muted returns, we don’t believe that dictates moving to a more conservative portfolio position, because we think it impacts the outlook for every asset class. We have and will continue to look for opportunities to enhance returns or reduce risk, where prudent. For example:

- Active managers, both long-only (in certain segments of the market) and long/short, might offer a slightly enhanced return profile as the world sorts out the winners and losers in this current market cycle.

- Private equity, while sensitive to some of the same cyclical factors as its public counterparts, can deliver the illiquidity premium that increases overall portfolio returns on the margin.

- The flexibility of absolute return and multi-sector bond funds offer an opportunity for a modest increase in returns over traditional bonds, which could be capped at their yields (unless we continue to test new lows on interest rates).

- Cash reserves for lifestyle expenses (6-12 months) can provide some reassurance as well as reduce the risk of having to raise cash at inopportune times, however, given current interest rates, holding excessive cash offers limited value.

Ultimately we remain long-term optimists, focused on the positive. Despite the ups and downs of the stock markets or newscycle, companies continue to innovate and provide essential goods and services to a growing global population. Famed value investor Benjamin Graham rationalized the market in a way we find insightful: In the short run, the market is like a voting machine, tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine, assessing the substance of a company.

As long-term investors, we believe that the global economy will continue to “gain weight,” and we advise Matter families to maintain the same position. There will be volatility. There will be periods during which your financial capital is worth less than it was a day, a month, or a year earlier. But such is the cycle and such is the cost of the ticket to ride. We’ll continue to seek opportunities to take advantage of whatever dislocations may arrive, but we’ll stay true to our discipline—and we won’t fancy ourselves oracles or market timers.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.