At Matter, we believe great investments aspire to great purposes. We work to find investments that positively impact all stakeholders—customers, communities, and shareholders. Sustainable investing represents the intersection of evolving social and investment perspectives that creates an opportunity to more fully align investments with the vision, values, and wealth purpose of each of our client families.

A sustainable or impact lens is an integral part of the investment strategy we use to build and manage portfolios for Matter families. We believe high-quality investments perform well because (not in spite) of the fact that they bring awareness and integration of environmental, social, and governance (ESG) factors into their process.

While sustainable, responsible, and impact investing seem to be hot topics, the concept has old roots. It started as “ethical investing” in the 1970s and has grown from being a niche strategy to one that’s relatively wide-ranging. Since history often provides valuable context for the present and insight into the future, it’s helpful to understand how sustainable investing has evolved over time.

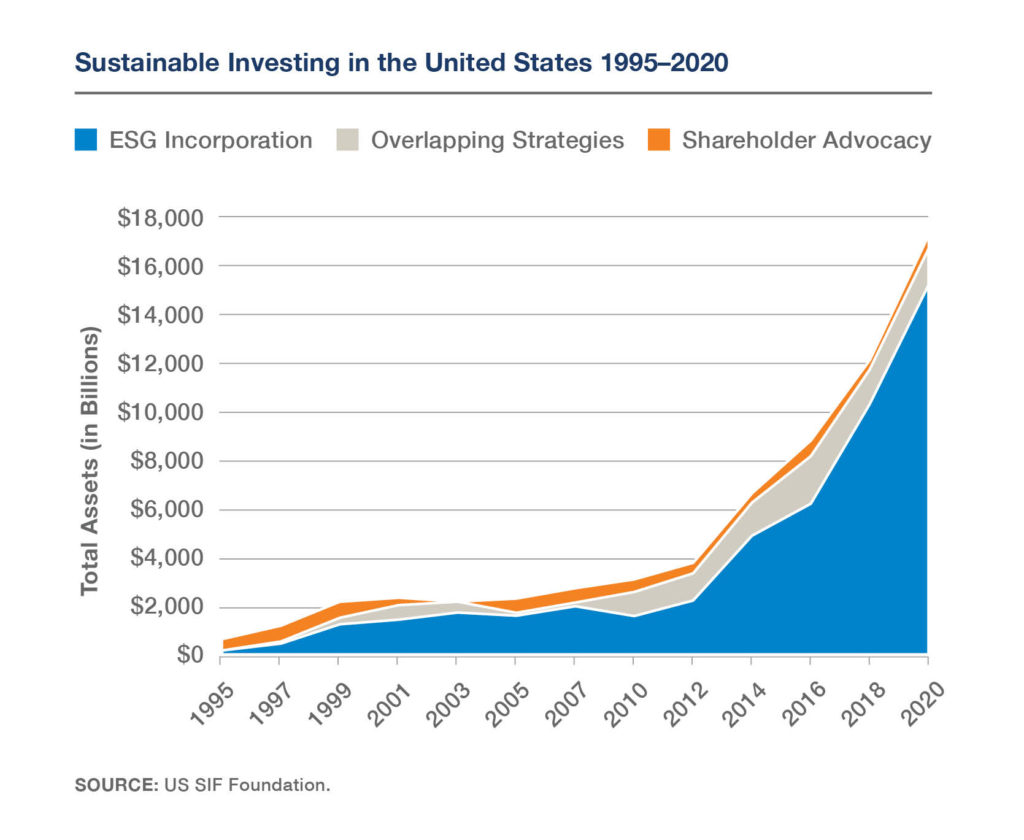

According to The Forum for Sustainable and Responsible Investment, the segment has exploded during the past decade.

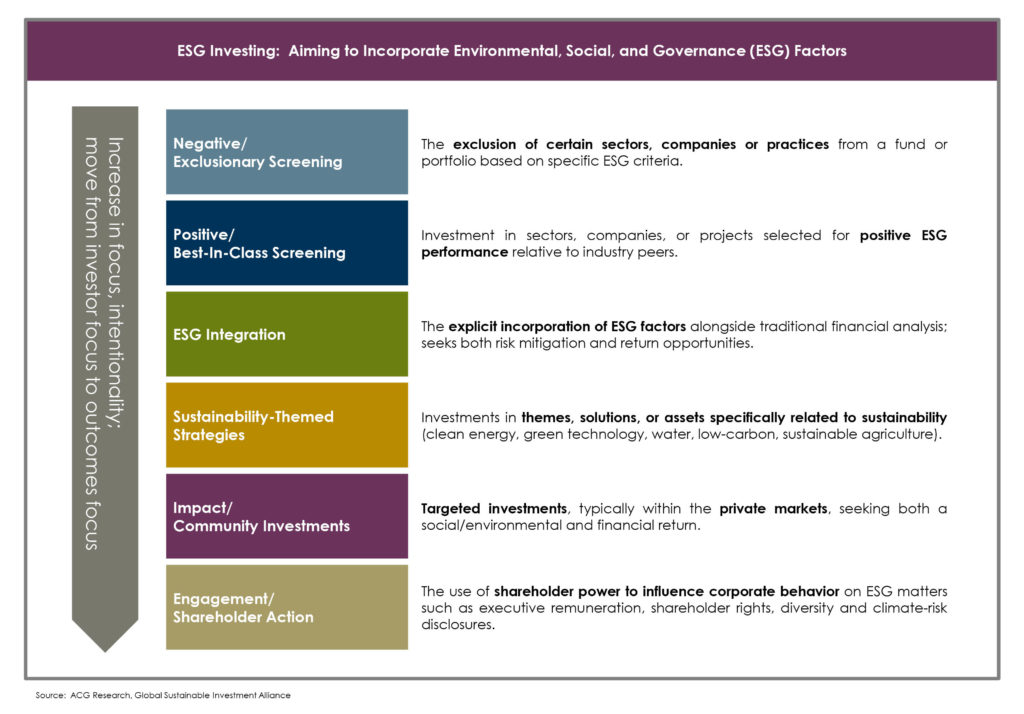

During this period of growth, the approaches to sustainable investing have also matured. What originated as a “do no harm” or negative/exclusionary screening has evolved into a variety of investment strategies, each with their own focus and perspectives which allow investors to identify and select investments that both bring benefit to the global ecosystem while not compromising return potential.

Our colleagues at Asset Consulting Group summarize these major categories:

At Matter, we have seen this evolution first hand, as the vast majority of the managers with whom we invest now have integrated ESG evaluation into their investment selection process across all asset classes—bonds, stocks and real estate to name a few. We believe that the additional layer of analysis provides investors with the ability to more fully understand the risks to the companies in which they are investing. That being said, for us, an investment with an ESG or impact stamp of approval doesn’t eliminate the need for further research and due diligence to determine if it’s the right fit for a portfolio. We welcome the challenge of discerning between those who talk the talk and those who walk the walk. We are grounded and heartened by the notion that this work allows us to create even more alignment between Matter families, their values and the investments we manage on their behalf.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.